By: Dr. Amelia Hart, CPA, and Steve Sledge, CPA

In 2022, the Tennessee CPA Journal reported on the newly released quality management standards (QMS).1 Today, with the effective date approaching, we provide important reminders and a discussion of (and reference to) some helpful resources for sole practitioners, small to medium firms, and other stakeholders.

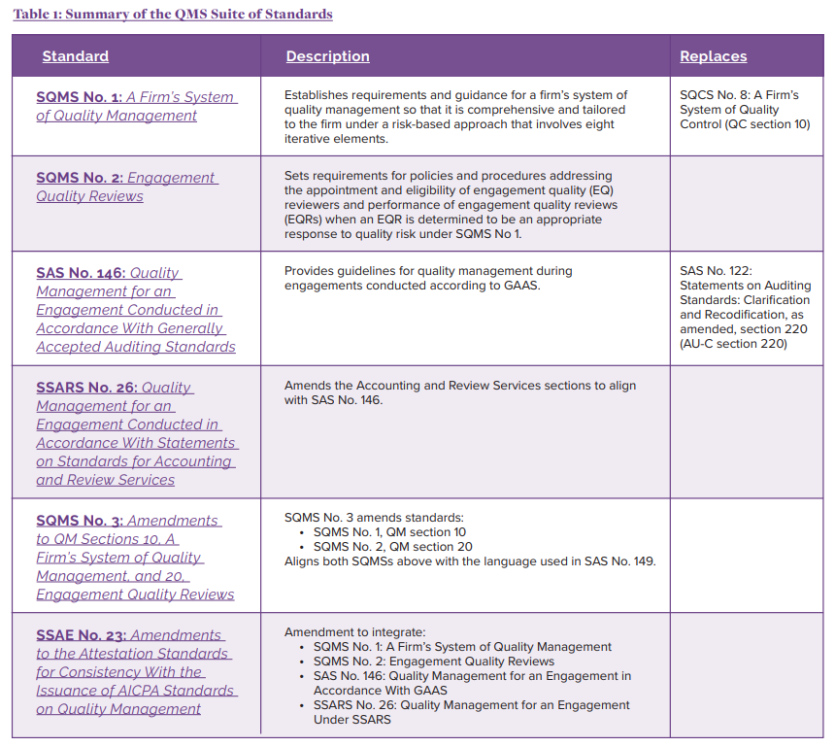

Quality management refers to a suite of standards that includes three American Institute of CPAs (AICPA) Statements on Quality Management Standards (SQMSs), one AICPA Statement on Auditing Standards (SAS), one AICPA Statement on Standards for Accounting and Review Services (SSARS), and one AICPA Statement on Standards for Attestation Engagements (SSAE).2 These composite standards outline the requirements for quality management in firms providing audit and attestation services. Two important dates related to the new system of QMS are:

- Implementation deadline: Systems must be implemented by Dec. 15, 2025.

- Review deadline: Systems must be established for review by Dec. 15, 2026.

This article reminds readers of the key points of the new QMS and also provides links to some of the resources available to firms, which range from videos, implementation guides, planning checklists and practice aids.

Key Points of the QMS

The system of quality management enhances a firm’s quality control by incorporating a risk-based approach and a risk assessment process tailored to the firm’s specific circumstances. The new QMS include the following standards that are codified by the AICPA.3

- SQMS No. 1: A Firm’s System of Quality Management

- SQMS No. 2: Engagement Quality Reviews

- SAS No. 146: Quality Management for Engagements Under Generally Accepted Auditing Standards

- SSARS No. 26: Quality Management for Engagements Under Accounting and Review Services

- SQMS No. 3: Amendments to QM Sections 10, A Firm’s System of Quality Management, and 20, Engagement Quality Reviews

- SSAE No. 23: Amendments to the Attestation Standards for Consistency With the Issuance of AICPA Standards on Quality Management

Summary of SQMS No. 1: A Firm’s System of Quality Management

SQMS No. 1 outlines a firm’s responsibilities to design, implement and operate a system of quality management for its accounting and auditing practices. This standard requires firms to establish policies and procedures for engagement quality reviews, with SQMS No. 2 addressing the specifics of reviewer appointment, eligibility, performance and documentation. The SQMS should be considered in conjunction with other professional standards and the AICPA Code of Professional Conduct.

SQMS No. 1 addresses eight components of a firm’s system of quality management: risk assessment, governance and leadership, ethical requirements, client relationships and

engagements, engagement performance, resources, information and communication, and monitoring and remediation.

Summary of SQMS No. 2: Engagement Quality Reviews

SQMS No. 2 focuses on the appointment and eligibility of the EQ reviewer, as well as their responsibilities in performing and documenting EQRs. This standard applies to all engagements determined to require an EQR in response to the assessment of quality risk under SQMS No. 1, which includes addressing assessed quality risks. The SQMS should be considered alongside the AICPA Code of Professional Conduct and other relevant ethical requirements.

SQMS No. 2 emphasizes that the firm is responsible for designing, implementing and operating its system of quality management, which includes establishing policies or procedures for EQRs.

Summary of SAS No. 146: Quality Management for an Engagement Conducted in Accordance With Generally Accepted Auditing Standards

This standard provides guidance on how firms should manage quality for engagements conducted in accordance with GAAS. It emphasizes the need for continuous monitoring and remediation to ensure that quality issues are identified and addressed in a timely manner.

SSARS No. 26: Quality Management for an Engagement Conducted in Accordance With Statements on Standards for Accounting and Review Services

Similar to SAS No. 146, this standard provides guidance on managing quality for engagements conducted in accordance with standards for accounting and review services.

Summary of SQMS No. 3: Amendments to QM Sections 10, A Firm’s System of Quality Management, and 20, Engagement Quality Reviews

The amendments to Quality Management (QM) sections 10 and 20 are linked to the prior SQMS Nos. 1 and 2. SQMS No. 3 was issued to create alignment with the wording found in SAS No. 149, Special Considerations — Audits of Group Financial Statements (Including the Work of Component Auditors and Audits of Referred-to Auditors).4 The amendments ensure consistency in terminology within SAS No. 149 to create a synergy across the standards.5

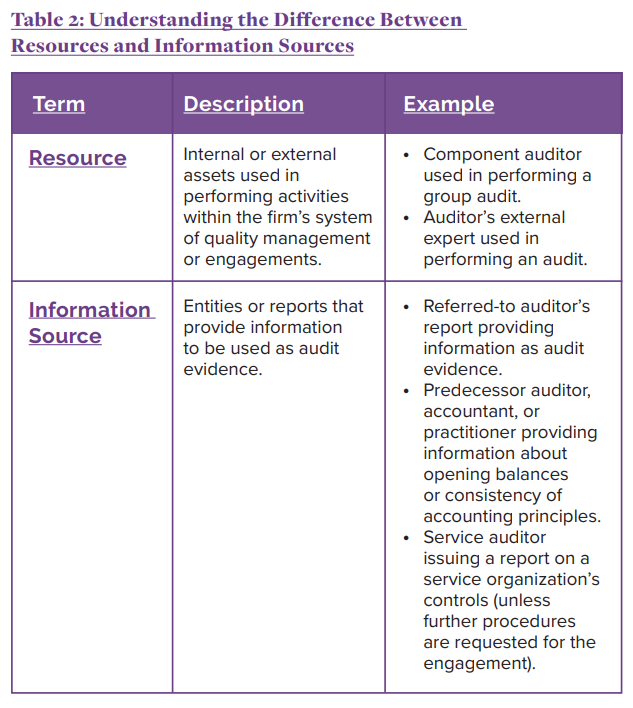

SQMS No. 3 also provides guidance on differentiating between a resource and an information source:

- Resources are actively used to perform tasks and achieve objectives within the quality management system. They can be internal or external assets directly involved in engagements.

- Information sources provide necessary data and insights that support audit evidence and decision-making but do not directly perform tasks.

Summary of SSAE No. 23, Amendments to the Attestation Standards for Consistency With the Issuance of AICPA Standards on Quality Management

Issued June 2024, SSAE No. 23 aligns certain concepts from the attestation standards with the new AICPA SQMS to ensure that the quality management practices used by firms performing attestation engagements are consistent with those established for audits and other covered services.6 The SSAE’s most significant change is replacing the term “other practitioner” with “participating practitioner” and “referred-to practitioner,” along with revising performance and reporting requirements to differentiate between these types.

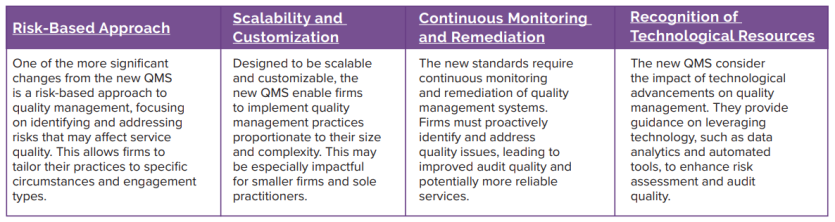

The New Standards in Contrast With Prior

The new QMS represent a shift from the current quality control standards. The current standards, which are based on the AICPA’s Statements on Quality Control Standards (SQCS), have been in place for many years and have historically provided the foundation for quality management in the accounting profession. However, the new QMS introduce several key changes that reflect the evolving landscape of accounting and auditing.

Helpful Resources for Implementing QMS

To facilitate the transition from the current quality control standards to the new QMS, the AICPA has provided a range of resources, including guidance for different-sized firms,

Establishing and Maintaining a System of Quality Management for a CPA Firm’s Accounting and Auditing Practice Aid Series; a crosswalk to help firms understand the changes; a four-part webinar series to guide practitioners through the implementation process; and a firm checklist.

Audit and Accounting Practice Aid Series

The AICPA released a set of practice aids in September 20237 and again in September 2024, more targeted at small and medium firms, as a part of an Audit and Accounting Practice Aid Series.8 This series offers comprehensive guidance on various aspects of auditing and accounting, with a particular focus on quality management. The Practice Aid Series includes detailed explanations, practical examples and step-by-step instructions to help firms implement the new QMS effectively. The Practice Aid Series covers several critical areas (or chapters), including Chapter 1: Overview of Statement on Quality Management Standards No. 1; Chapter 2: Overview of Risk Assessment Requirements; Chapter 3: Library of Quality Objective, Potential Risks, and Potential Responses; and Chapter 4: Monitoring and Remediation.

Crosswalk: A Mapping of the Key Differences That the New SQMSs Introduce

To further facilitate the transition, the AICPA has developed a crosswalk that helps firms understand the changes from the current quality control standards to the new QMS. The crosswalk provides a side-by-side comparison of the old and new standards, highlighting the key differences and offering practical insights into how to adapt existing practices to meet the new requirements. The differences between the previous and the current standards are described and presented in the document Mapping between SQMS No. 1 and SQCS No. 8, as amended.9 The mapping document also explains the risk assessment process, including setting quality objectives, assessing risks and implementing responses with a roadmap for firms to follow.

Videos, Webinars and Training Programs

The AICPA offers a range of tools to help orient firms and create a more accessible compliance experience. This includes videos such as one explaining how the quality management practice aid can guide a firm through implementing the standards.10

The AICPA also provides webinars and training programs to support firms in implementing the new QMS. These programs are designed to provide practitioners with the knowledge and skills needed to navigate the transition from the current quality control standards to the new QMS.11

The AICPA’s four-part webinar series is particularly valuable, as it guides practitioners through the implementation process step-by-step. The webinars cover topics such as understanding the new standards, developing a tailored quality management system, conducting EQRs, and leveraging technology to improve quality management.

Checklist for a Quality System Implementation

The AICPA provided a checklist12 that was published November 2022 to support planning for the implementation of the quality management system. The Statements on Quality Management Standards Implementation Checklist was designed for CPA firms conducting engagements under SASs, SSARSs or SSAEs. The AICPA and CIMA have developed a detailed checklist to guide firms through key steps, milestones and risk assessments, simplifying the implementation process. The checklist also includes links to additional resources, such as a mapping document that outlines changes between SQMS No. 1 and SQCS No. 8.

Importance of Planning for Implementation

The proactive and tailored approach to quality management promoted by the new system of QMS represents a significant step forward for the public accountancy profession, and the AICPA’s resources are invaluable in helping firms achieve compliance and quality in their practice. Firms have been encouraged to plan and prepare to ensure compliance with new QMS in accordance with the implementation dates. Regardless of a firm’s implementation status, continuing to consider the standards and the reference implementation tools may be a useful exercise as the dates approach.

References

1The July/August 2022 Tennessee CPA Journal article by Amelia Hart and Steve Sledge, “Auditing Standards Board Issues Quality Management Standards: Introduces Risk-based Approach.”

2Journey to Quality Management is a resource summarizing the quality management system and is retrievable at https://bit.ly/aicpajourneyqm.

3The respective codification is affected by the quality management standard as follows:

• The Statements on Quality Management Standards (SQMSs), codified as QM sections in AICPA Professional Standards.

• Statements on Auditing Standards (SASs), codified as AU-C sections in AICPA Professional Standards.

• Statements on Standards for Accounting and Review Services (SSARSs), codified as AR-C sections in AICPA Professional Standards.

• Statements on Standards for Attestation Engagements (SSAEs), codified as AT-C sections in AICPA Professional Standards.

4SAS No. 149 supersedes SAS No. 122, Statements on Auditing Standards: Clarification and Recodification, as amended, section 600, Special Considerations — Audits of Group Financial Statements (Including the Work of Component Auditors) (AU-C sec. 600).

5SQMS No. 3 is available at https://bit.ly/aicpasqms3.

6SSAE No. 23 amends: Statement on Standards for Attestation Engagements (SSAE) No. 18, Attestation Standards: Clarification and Recodification, as amended, AT-C section 105, Concepts Common to All Attestation Engagements (AICPA, Professional Standards, AT-C sec. 105); SSAE No. 19, Agreed-Upon Procedures Engagements (AICPA, Professional Standards, AT-C sec. 215); SSAE No. 21, Direct Examination Engagements (AICPA, Professional Standards, AT-C sec. 205); SSAE No. 22, Review Engagements (AICPA, Professional Standards, AT-C sec. 210).

7In September 2023, the AICPA Introduced Quality Management Practice Aid to Enhance Accounting and Auditing Practices at https://bit.ly/aicpaqmaid.

8This free practice aid, Set up your A&A quality management system – Small- and Medium-Sized Firms Resource, is available at https://bit.ly/aicpasmmed.

9The crosswalk that shares the mapping of differences is available at https://bit.ly/aicpacrosswalk.

10The video, The crucial tool for enhancing A&A quality management, is available at https://bit.ly/aicpavideotool.

11https://bit.ly/aicpajourneyqm

12The firm checklist to guide your quality management system is available at https://bit.ly/aicpafirmchecklist.

About the Authors

Dr. Amelia Hart, CPA, serves on the faculty of the Haslam College of Business in the Department of Accounting and Information Management at the University of Tennessee, Knoxville. She can be reached at ihart@utk.edu.

Steve Sledge, CPA, is an audit partner at Anglin Reichmann Armstrong. He can be reached at sdsledge@outlook.com.

This article was originally published in the March/April 2025 Tennessee CPA Journal.