By: Emily Cokeley, Ph.D., CPA, and Lingting Jiang, Ph.D., CPA

In recent years, there have been numerous natural disasters in Tennessee and neighboring states, leading to substantial economic losses. Disaster losses impose significant financial burdens on individuals and businesses. The U.S. tax code provides relief through casualty loss deductions, special tax provisions and legislative acts aimed at mitigating the economic impact of natural and man-made disasters.

With tax law constantly in flux, CPAs find that there are frequent updates to IRS publications, forms and instructions. We want to call your attention to the very recent enactment (Dec. 12, 2024) of the Federal Disaster Relief Act of 2023 (FDRA 2023), resulting in significant changes to previous tax law and the information included within IRS Publication 547 and Form 4684 (and the corresponding instructions), specifically regarding the tax treatment of qualified disaster losses. This column discussed the tax treatment of disaster losses in the November/ December issue of the Tennessee CPA Journal, and we want to provide information about the changes made in that short amount of time that can have significant positive impacts on taxpayers living in areas affected by disasters. Form 4684 Instructions and Publication 547 have been updated to reflect the changes due to the FDRA 2023.

Qualified Disaster Losses

For several years prior to the 2024 update, the only casualty loss categories that were available for taxpayers to claim were “federal casualty losses” and “disaster losses.” Both categories are considered federally declared disasters as determined by the U.S. president. A federal casualty loss refers to the loss of an individual’s personal-use property that is attributable to a federally declared disaster and must occur within a state receiving a federal disaster declaration, while a disaster loss refers to the loss of an individual’s or business’ personal- use or income-producing property that is attributable to a federally declared disaster and must occur within a county eligible for public and/or individual assistance.

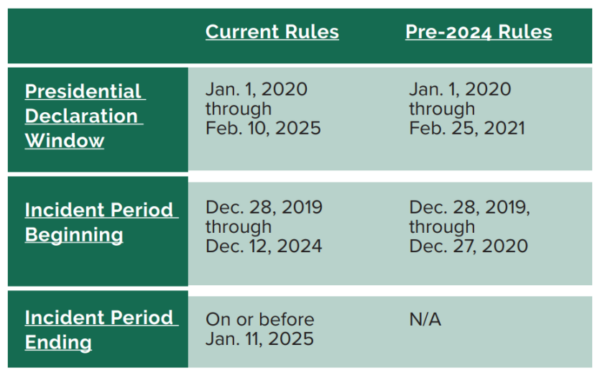

Until the enactment of FDRA 2023, a third casualty loss category, “qualified disaster loss,” existed but was unable to be used in recent years since a qualified disaster loss is limited to very specific disasters and timeframes (Hurricanes Harvey and Maria and the California wildfires in 2017 and early 2018, for example). In addition to the specific disasters noted, any other major disaster declared by the president between Jan. 1, 2020, and Feb. 25, 2021, and with an incident period that began between Dec. 28, 2019, and Dec. 27, 2020, could result in a qualified disaster loss, as long as the loss was an individual’s loss of personal-use property. With no updates to the timeframe for four years, taxpayers with more recent casualty losses were unable to use the qualified disaster loss designation.

With FDRA 2023, qualified disaster losses continue to include an individual’s loss of personal-use property (the designation does not apply to businesses or income- producing property), but the disaster declaration window and incident period have now been extended to include presidential disaster declarations through Feb. 10, 2025, with incident periods beginning no later than Dec. 12, 2024. An additional stipulation has been added in which the disaster must have ended no later than Jan. 11, 2025. The extended timeframes now allow for losses due to disasters like Tropical Storm Helene (East Tennessee) and severe weather and tornadoes (Middle Tennessee) in 2024 to be considered qualified disaster losses.

Benefits of the Qualified Disaster Loss Designation

It is important to note that the three casualty loss categories discussed in the section above each have their own unique qualifications and benefits. Per the IRS, if an individual suffered a disaster loss, they are eligible to claim a casualty loss deduction and to elect to claim the loss in the preceding tax year, but claiming a qualified disaster loss provides perhaps the most significant benefits of all the disaster loss categories. First, taxpayers claiming a qualified disaster loss have the option to deduct the loss through an increased standard deduction – claiming itemized deductions is not required. Second, the net casualty loss does not need to exceed 10% of AGI to qualify, nor does it need to be reduced by 10% of AGI when claiming a qualified disaster loss, but the $100 reduction used in calculating federal casualty losses and disaster losses is increased to $500 for qualified disaster losses. These benefits to claiming a qualified disaster loss (instead of the other two disaster loss categories) make it easier for more taxpayers to receive relief.

To claim the increased standard deduction instead of claiming itemized deductions, the taxpayer will show an increase to their standard deduction using Schedule A, Line 16 (other itemized deductions) by entering the amount of their qualified disaster losses less the $500 reduction on the dotted text line next to Line 16. Also on this text line, the preparer should enter the taxpayer’s standard deduction amount, and enter the total of the qualified disaster losses and the standard deduction in the entry space for Line 16. This total will then also be entered on Form 1040, Line 12 (standard deduction or itemized deductions). In this way, the qualified disaster losses can be deducted from adjusted gross income even if the taxpayer takes the standard deduction.

Retroactive Claims

Since the 2024 update extends the incident and declaration windows instead of simply adding additional windows, this allows for a retroactive application of the qualified disaster loss rules. In Tennessee alone, there were six disasters that occurred during 2023,

two disasters that occurred during 2022, and four disasters that occurred during 2021 in which losses that resulted from these disasters were not eligible for qualified disaster status until the FDRA 2023 update in December 2024 (fema. gov/disaster). There are likely many more disasters in surrounding states that can now also be considered for qualified disaster losses. Taxpayers may claim these qualified disaster losses experienced in prior years by filing amended returns for those years.

Specific Disasters Covered and Not Covered by FDRA 2023

It is important to note that while the timeframe for qualified disaster losses has been extended, certain losses are explicitly excluded from qualified disaster loss eligibility at this time. These excluded losses are:

- Any major disaster that has been declared only by reason of COVID-19

- California wildfires that began in 2025 (this disaster does not fall within the required incident window)

Two disasters have received special attention in the FDRA 2023, however, and it allows for qualified disaster relief payments to be excluded from the income of individuals to the extent that losses, expenses or damages compensated for by qualified relief payments are not otherwise compensated for by insurance or other reimbursement. Such payments are not subject to income tax, self-employment tax or employment taxes such as Social Security, Medicare, and federal unemployment taxes.

To address losses and disaster relief payments resulting from the East Palestine, Ohio, train derailment disaster in 2023, qualified relief payments include compensation provided by

a government agency or by Norfolk Southern Railway (or related parties) for:

- Loss, damages or expenses

- Loss in real property value

- Closing costs with respect to real property

- Inconvenience

The act does not include as qualified disaster relief payments any payments for expenses otherwise paid for by insurance or other reimbursements (no double-dipping) and payments to replace lost income, including lost wages, lost business income or unemployment compensation.

To address losses and disaster relief payments resulting from any forest or range fire declared a federal disaster in 2015 or later, qualified wildfire relief payments include payments received between Jan. 1, 2020, and Dec. 31, 2025, that are intended to compensate an individual for:

- Additional living expenses

- Lost wages (other than compensation paid by your employer)

- Personal injury or death

- Emotional distress

Like qualified payments for the East Palestine train derailment, qualified payments for these forest or range fire disasters may also be excluded from individual income.

Challenges and Future Considerations

Despite the positive changes introduced by the FDRA 2023, several challenges remain. These issues could impact the effectiveness of disaster tax relief and may require further legislative adjustments – most notably, continuing legislation to frequently extend the timelines for disasters that provide the option to claim qualified disaster losses. Additionally, many taxpayers are unaware of the tax benefits available to them after a disaster. The IRS and tax preparers may be of service to affected taxpayers by getting the word out about relief opportunities following disasters. The complexity of tax laws could also mean that some individuals may not take full advantage of the relief measures in the absence of a knowledgeable tax preparer.

Conclusion

The FDRA 2023 update to the tax treatment of disaster losses may allow taxpayers a greater benefit than they would have received had they continued to be required to itemize their deductions in order to take the casualty loss, and the difference in benefit between the two options should be calculated on an individual basis when preparing returns for those affected by these disasters. In addition, since the FDRA 2023 is retroactive, tax clients who suffered casualty losses may also benefit from a review of their prior-year tax returns to determine if they would be eligible for a refund as a result of the changes in the FDRA 2023. While this article presents basic information about the December 2024 update under the FDRA 2023, tax preparers will benefit from examining more detailed situations, examples and instructions in the IRS documents noted in the references that follow this article. As natural disasters continue to cause destruction and loss, continued legislative improvements will be essential to ensuring effective relief.

About the Authors

Emily Cokeley, Ph.D., CPA, is an assistant professor at East Tennessee State University. She can be reached at cokeley@etsu.edu.

Lingting Jiang, Ph.D., CPA, is an assistant professor at East Tennessee State University. She can be reached at jiangl@etsu.edu.

References

Internal Revenue Service. (2025, February 5). Publication 547: Casualties, Disasters, and Thefts - DRAFT.

Internal Revenue Service. (2025, February 4). Instructions for Form 4684: Casualties and Thefts.

http://www.fema.gov/disaster

This article was originally published in the March/April 2025 Tennessee CPA Journal.