By: Dr. Amelia Hart, CPA, and Steve Sledge, CPA

Recent economic developments, including shifts in inflation trends, interest rate fluctuations, global supply chain considerations, and evolving geopolitical conditions, are prompting many organizations to evaluate how recent events will impact their financial reporting processes and respective results. These dynamics can impact considerations around asset valuations, fair value assessments, credit risk, liquidity management and operational flexibility.

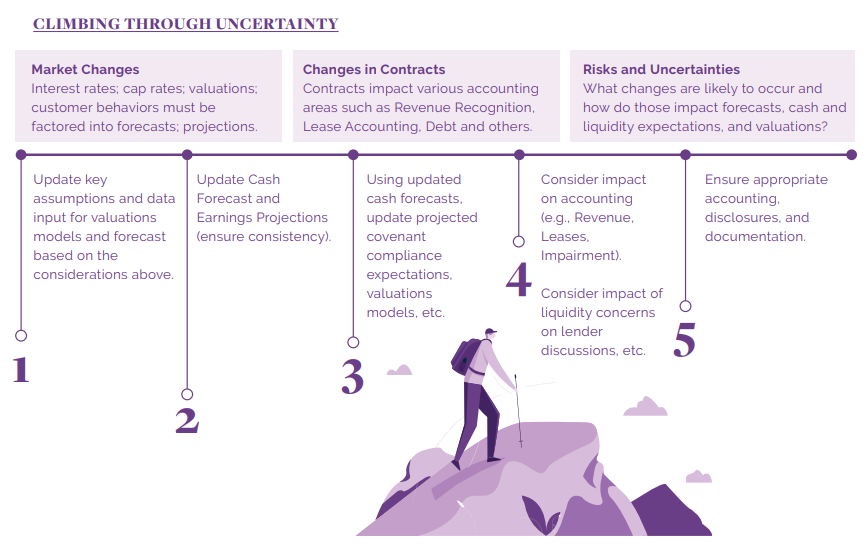

Changing market conditions and resulting customer behaviors can make it more challenging to anticipate results of operations, evaluate assets and forecast cash flows. For accounting and finance professionals, this may translate into operational adjustments, as well as heightened attention to financial reporting judgments and estimates. Navigating these challenges requires careful application of U.S. GAAP or other applicable standards as well as a thoughtful evaluation of the impacts on an organization’s financial statements and related disclosures.

This article explores how economic developments may influence accounting estimates, disclosures, and internal controls and outlines how organizations can proactively respond. Auditors should exercise due care when considering these factors in their risk assessments and subsequent audit planning and testing.

The content in this article is intended for general informational use and does not constitute comprehensive accounting, finance or legal advice, nor is it a substitute for professional services. Readers are encouraged to consult expert assistance or consult the relevant professional standards as needed.

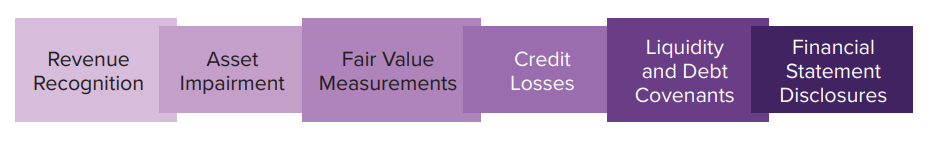

Key Financial Reporting Areas Affected by Economic Uncertainty

Economic volatility affects practically every facet of financial reporting, from revenue forecasts to asset valuations. In uncertain times, management must revisit assumptions, apply heightened skepticism to projections, and ensure that financial statements accurately reflect the risks and realities of the underlying business environment. Several accounting and financial reporting areas are particularly sensitive.

Revenue Recognition

Economic disruption can lead to changing customer behavior, renegotiated contracts, an increase in cancellations, and returns. ASC 606, Revenue from Contracts with Customers,1 provides comprehensive guidance on contract modifications, performance obligations, identifiable rights, payment terms, commercial substance and the probability of collection. Organizations may need to revisit the elements of their revenue from contracts with customers, especially the measurement of variable consideration, ensuring that revenue recognition estimates remain appropriate. Additionally, estimates for returns, rebates and discounts may be impacted by changes in customer behavior. Contract modifications, including changes in pricing or performance obligations, must be assessed carefully to determine whether they should be accounted for as separate contracts or as changes to existing contracts.

Asset Impairment

Indicators of impairment for assets including goodwill, intangibles and long-lived assets are often more prevalent during times of economic uncertainty. ASC 350-20, Goodwill,2 and ASC 360-10, Impairment or Disposal of Long-Lived Assets,3 provide guidance on the indicators and measurement of impairment. Organizations should appropriately reassess whether carrying amounts are recoverable, using updated cash flow forecasts that reflect any revised market conditions and related assumptions. Discount rates may increase due to heightened risk premiums, potentially triggering impairment losses for goodwill or other certain intangible assets even if historical performance remains steady. Early identification of potential impairment indicators and timely impairment testing and transparent disclosures are important both for compliance and transparency in reporting.

Fair Value Measurements

Heightened market volatility affects fair value estimates, particularly for assets or markets where observable inputs are limited. ASC 820-10-35-37 through ASC 820-10-35-55, Fair Value Hierarchy, provide specific guidance4 on fair valuation. Valuations classified as Level 2 or Level 3 under the ASC 820 codification may require enhanced consideration of the respective valuation models, the data and assumptions. Organizations should ensure that valuation models incorporate current market conditions and that disclosures provide sufficient detail about assumptions, methodologies, and any changes from prior periods.

Credit Losses

Credit risk often intensifies during economic downturns. Under the current expected credit loss (CECL) model, organizations must adjust their loss estimates based not only on historical experience but also on the consideration of reasonable and supportable forecasts. This may necessitate revisions to models, overlays or qualitative adjustments to reflect the macroeconomic outlook. ASC 326-20, Financial Instruments – Credit Losses Measured at Amortized Cost, and ASC 326-30, Financial Instruments – Credit Losses Available-for-Sale Debt Securities, provide guidance on how to account for credit losses.5

Liquidity and Debt Covenants

Liquidity pressures during times of uncertainty can make compliance with financial covenants more difficult. Failure to meet covenants is a key risk factor for many investors, lenders and creditors. Organizations should proactively monitor covenant calculations and engage with lenders early if potential breaches seem likely. Management must also consider the impact of liquidity risks relative to the going concern assessment. If applicable, they should prepare appropriate disclosures under ASC 205-40, Going Concern, should substantial doubt exist about the entity’s ability to continue as a going concern.6

Financial Statement Disclosures

In times of economic turbulence, the need for robust and transparent disclosures takes on a new level of significance. Stakeholders seek insight into the judgments, assumptions and underlying risk factors. Financial disclosures should provide a clear narrative of any uncertainty and how the organization is responding to uncertainty. ASC 235, Notes to Financial Statements, focuses on content and relevance of disclosures in financial statements.7

Disclosures are to be informative; for example, organizations facing actual or potential significant supply chain disruption (e.g., significant pricing increases or delays) or customer defaults should consider the appropriateness of disclosures related to operational risks and how they may impact future financial performance. There is specific Accounting Standards Codification that provides targeted guidance on disclosures that may need to be consulted.8

Internal Controls and Governance

Economic volatility can expose new internal control vulnerabilities. Boards of directors, audit committees, management (i.e., those charged with governance), and the underlying control owners should reassess their control environments and risk assessments. The appropriate parties should evaluate the impact on internal controls to ensure they remain effective and that documentation is updated as necessary. Auditors should consider any vulnerabilities and changes as part of their risk assessment and testing. Those charged with governance should also remain actively involved during periods of uncertainty.

Plan Ahead and Learn From the Aftermath

Navigating economic uncertainty requires more than technical compliance; it demands proactive leadership, robust processes and clear communication. Organizations that move quickly to reassess their assumptions, reinforce controls and engage transparently with internal stakeholders will be better positioned to navigate through uncertainty. There must also be intentional efforts at communications with external value chain partners – customers and suppliers as key members of the ecosystem of a business. In the aftermath of a period of economic uncertainty that required quick pivots or decisions, it is advisable to reflect on the organizational response, lessons learned and opportunities that may serve the entity well as it moves forward.

Document Everything

As with any significant financial reporting positions, take time and effort to capture accurate and thorough documentation of the various positions taken and conclusions reached during this period. This includes underlying models, assumptions, data and the respective narratives to support the financial reporting. Documenting the organization’s response during times of uncertainty can be the greatest source of learning in building organizational resilience during periods of economic certainty. Taking the time and exercising the discipline to update documentation based on underlying changes can provide the organization an opportunity to rethink the design of controls and some of its technical accounting positions which are value-added over the long term.

Conclusion

Economic uncertainty challenges organizations to rethink, remeasure and strategize for what is next. While volatility can put pressure on financial reporting systems and expose challenges, it also presents an opportunity for organizations to demonstrate their flexibility, transparency and strategic foresight. By proactively reassessing their financial position, significant estimates, note disclosures, internal controls, and valued stakeholder relationships, organizations have an opportunity to inspire trust. While uncertainty is possibly the new normal, organizations that adapt thoughtfully will emerge stronger, more credible, and better prepared for future success and sustainability.

About the Authors

Dr. Amelia Hart, CPA, serves on the faculty of the Haslam College of Business in the Department of Accounting and Information Management at the University of Tennessee, Knoxville. She can be reached at ihart@utk.edu.

Steve Sledge, CPA, is an audit partner at Anglin Reichmann Armstrong. He can be reached at sdsledge@outlook.com.

References

1Revenue from Contracts with Customers, ASC606, is available in full, with changes from Accounting Standards Updates, at https://bit.ly/fasbasc606. ASC 606 provides a framework for recognizing revenue from contracts with customers based on the transfer of goods or services in exchange for consideration using a five-step process. It also requires detailed disclosures to help users understand the nature, amount, timing, and uncertainty of revenue and related cash flows.

2ASC 350-20, Goodwill, provides that goodwill is not amortized but is tested annually for impairment at the reporting-unit level, comparing the unit’s carrying amount (including goodwill) to its fair value. Entities may perform a qualitative assessment to determine if a quantitative test is needed, based on whether it’s more likely than not that the reporting unit’s fair value is less than its carrying amount. If impairment exists, a loss is recognized for the excess of carrying amount over fair value, limited to the amount of goodwill allocated to the unit, and adjusted for any related tax effects. ASC 350-20 is available at https://bit.ly/fasbasc35020.

3ASC 360-10, Impairment or Disposal of Long-Lived Assets, provides guidance on the impairment or disposal of long-lived assets, including the process for reviewing and measuring assets intended to be held and used, and those held for disposal, before actual disposition. An impairment loss is recognized if the carrying amount of an asset exceeds its fair value and is not recoverable, based on expected undiscounted cash flows. If impairment occurs, the asset’s adjusted carrying amount becomes its new cost basis, and it should be tested for recoverability whenever significant changes or events indicate it may no longer be recoverable. ASC 360-10 is available at https://bit.ly/fasbasc36010.

4ASC 820, Fair Value Hierarchy, classifies inputs used in valuation techniques into three levels to improve consistency and comparability in fair value measurement. ASC 820-35-35-37 through 35-55 defines each level and is available at https://bit.ly/fasbasc820. The three levels’ inputs vary as follows:

- Level 1 inputs are quoted prices in active markets for identical assets or liabilities, considered the most reliable and used without adjustment when available.

- Level 2 inputs are observable, either directly or indirectly, such as quoted prices for similar assets or market-corroborated inputs, and may require adjustments depending on asset-specific factors.

- Level 3 inputs are unobservable and used when observable inputs are not available, relying on the entity’s assumptions about what market participants would use, including risk considerations and market participant data when reasonably available.

5ASC 326-20 guidance for developing an estimate of expected credit losses (CECL) under ASC 326-20 specifies that entities must estimate and record an allowance for credit losses under the current expected credit loss (CECL) model, which reflects lifetime expected losses using historical experience, current conditions, and reasonable forecasts. Credit losses are generally measured collectively for similar-risk assets using various methods (e.g., discounted cash flows, loss-rate models). The allowance is recorded through net income and considers prepayments, credit enhancements, and off-balance-sheet exposures. ASC 326-20 is available at https://bit.ly/fasbasc32620.

ASC 326-30 addresses available-for-sale debt securities; these are considered impaired when their fair value falls below amortized cost, and entities must evaluate whether this decline is due to credit loss or other factors. Credit-related impairments are recognized through an allowance for credit losses (not a direct write-down), limited to the difference between amortized cost and fair value, while non-credit losses flow through other comprehensive income (OCI). Impairment is assessed at the individual security level, and if the entity intends or is likely to be required to sell the security, the full impairment is recognized in earnings. ASC 326-30 guidance is available at https://bit.ly/fasbasc32630.

6As part of the organization’s and the auditor’s assessment of whether substantial doubt is raised about the entity’s ability to continue as a going concern for a period of year from the date that the respective financial statements are available for release, the entity and the auditor should consult ASC Subtopic 250, SAS 126, and AS 2415. The full Codification on accounting for goodwill is retrievable at https://bit.ly/fasbasc20540.

7ASC 235, Notes to Financial Statements, provides expansive guidance that will be helpful to preparers, with emphasis on accounting policies most appropriate for fairly presenting the financial statements. It is available at https://bit.ly/fasbasc235.

8Additional guidance is available for reference, including but not limited to: ASC 275, Risks and Uncertainties (examples, concentration risk, major suppliers/customers, etc.); ASC 820, Fair Value Measurement (example, disclosure of valuation techniques); ASC 740, Income Taxes (example, deferred taxes or uncertain tax positions); ASC 855, Subsequent Events (events occurring after balance sheet date but before financials are issued).

This article was originally published in the May/June 2025 Tennessee CPA Journal.