The path to CPA licensure in Tennessee has expanded with the recent passage of SB 1316/HB 1330, known as the Less is More Act of 2025. Cosponsored in the Tennessee General Assembly by Senate Majority Leader Jack Johnson and House Majority Leader William Lamberth, the legislation adds an additional pathway to CPA licensure as well as protects interstate practice privileges for CPAs. Gov. Bill Lee signed the legislation into law on May 21.

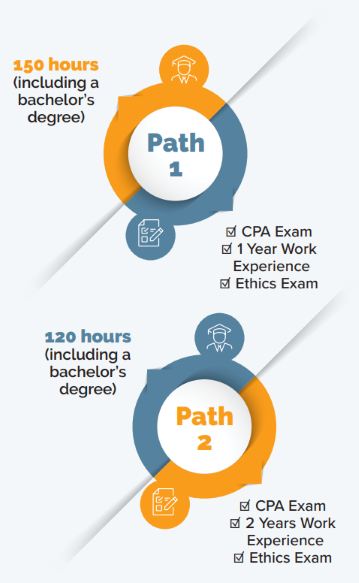

Beginning Jan. 1, 2026, prospective CPAs may either 1) complete at least 150 semester hours of college education including a bachelor’s degree plus one year of accounting experience or 2) complete at least 120 semester hours of college education including a bachelor’s degree plus two years of accounting experience. Additionally, as of July 1, 2025, current and future CPAs who do not have a principal place of business in Tennessee can practice in the state if they hold a valid CPA license in good standing from another state and if, at the time of licensure, they showed evidence of having passed the Uniform CPA Examination (CPA Exam). For more information about the legislation, see “Tennessee Passes CPA Licensure Bill,” published in the May/June 2025 issue of the Tennessee CPA Journal.

For both licensure pathways, there are several requirements that will remain the same.

- Prospective CPAs in Tennessee are still required to obtain a bachelor’s degree with an accounting concentration, which includes 30 semester hours of accounting education.

- For licensure, the prospective CPA must complete 24 semester hours of upper-division accounting, as well as 24 additional hours of general business education. Refer to section 0020-02 of the Rules of the Department of Commerce and Insurance Division of Regulatory Boards, Tennessee State Board of Accountancy (TSBOA) for more information and clarification.

- Additionally, for both licensure pathways, prospective CPAs are still required to pass all four parts of the CPA Exam as well as earn a score of 90% or better on the American Institute of CPAs (AICPA) Professional Ethics Exam.

The most significant change the legislation makes to CPA licensure in the state is that prospective CPAs now have the option to substitute a second year of work experience for the additional 30 hours of college education required with the traditional pathway. In May, TSCPA held a virtual town hall with TSBOA to address questions from members regarding the legislation. Several questions from town hall attendees are presented below.

New Licensure Pathway FAQs

Q: Can I take the CPA Exam before completing all my education?

A: A bachelor's degree is required to sit for the CPA Exam. You may apply prior to obtaining your bachelor's degree but cannot sit for the Exam.

Q: How long are my CPA Exam scores valid?

A: Once you receive your first passing score, the score is valid for 30 months. You must pass all four sections within the 30-month period.

Q: Do internship hours count towards experience hours?

A: Yes, you can count internship hours towards your one or two years of experience as long as they meet the experience requirements and a CPA is able to sign off on your experience

verification form.

Q: Can internship hours count towards education requirements?

A: Yes, you can count up to nine hours of internship credit towards your accounting education hours (six of which can count towards upper division).

Q: If I get my CPA license in Tennessee, can I transfer it to another state in the future?

A: Many states allow licensed CPAs in good standing to apply for a license in another state through reciprocity. This means you don’t have to retake the CPA Exam, just meet that state’s application requirements. Always check with the board of accountancy of the state you are considering for their specific rules.

Q: Does the work experience have to occur after the effective date of Jan. 1, 2026?

A: No, experience can be obtained prior to the effective date of the law, which is Jan. 1, 2026.

Pam Church, CPA, Ph.D., Rhodes College associate professor emeritus and former dean and accounting professor of the Christian Brothers University School of Business, served three terms on TSBOA and has focused much of her recent research on new hires’ assimilation into public accounting firms. She believes Tennessee’s new licensure pathway will have a significant impact on students and the profession. “This new pathway will offer

additional flexibility as people consider what plan will work best for their unique situation,” said Dr. Church. “The personal financial implications of this new option cannot be ignored. CPA candidates will have the opportunity to earn a full-time salary immediately after undergraduate school without the burden of additional tuition costs or the stress of combining additional coursework with a full-time job while studying for the CPA Exam.”

"As someone aspiring to become a CPA in the next few years, I’ve been closely following this bill. The financial burden tied to meeting the 150-hour requirement has long been a significant barrier to entry. Many students working through college struggle to balance achieving 150 credit hours while maintaining strong academic performance. For those of us (myself included) who didn’t reach 150 hours during undergrad, the next step often means figuring out how to finance graduate school — with many having to take out loans.

This new pathway to CPA licensure offers hope. It has the potential to ease the financial burden and create opportunities for students who might otherwise have been unable to pursue this incredible career. I’m excited to see the positive changes this bill could bring!"

-Hollie Janovich

University of Memphis

If you have questions about the licensure changes in Tennessee, please contact the society office at tscpa@tscpa.com. To learn more about TSCPA’s legislative advocacy efforts, visit http://www.tscpa.com/advocacy-toolkit.

References

http://www.tscpa.com/tscpalicensurepathways

https://bit.ly/tscpamayjune25

https://bit.ly/tnaccountancyrules

https://bit.ly/futurecpatownhallvideo

https://bit.ly/aicpanasbablog

https://bit.ly/nasbauaa25

This article was originally published in the September/October 2025 Tennessee CPA Journal.