By: Natalie Rooney

According to a spring 2023 survey for Accounting Today's Top 100 Firms and Regional Leaders report, the country’s leading accounting firms identified 20 major problems they'll be dealing with in the future. Staffing, and staffing-related issues, make up the top five spots out of the 20 identified. This two-part article series takes a deep dive into the challenges the CPA profession is facing related to talent recruitment and retention.

Part One: The Data Behind the Decline

According to the Bureau of Labor Statistics, more than 300,000 U.S. accountants and auditors have left their jobs over the past few years—a 17% decline in overall industry employment. Data from the AICPA indicates this downward trend will continue as baby boomers leave the workforce, with 75% of CPAs retiring or approaching retirement over the next 15 years.

Over the last several years, university accounting departments have also seen their numbers slide as fewer students choose to major in accounting. The AICPA’s 2021 Trends report shows a 2.8% decrease in accounting bachelor’s graduates for the 2019–2020 academic year and an 8.4% decrease in accounting master’s graduates.

The number of people who took the CPA exam in 2022 was about 67,000, down from 72,000 in 2021—the lowest number in 17 years.

The numbers in Tennessee tell a similar story, with a drop off of more than 300 exam takers over the last five years:

- 2017: 870

- 2018: 730

- 2019: 725

- 2020: 610

- 2021: 568

- 2022: 558

New CPA Exam Candidates by Year – Tennessee

What’s driving the drastic drop in accounting majors? There isn’t one single reason, but first and foremost, there just aren’t as many students.

A May 2022 report from the National Student Clearinghouse Research Center shows enrollment of undergraduate students fell 9.4%, or nearly 1.4 million students, from spring 2020 to spring 2022, and 2.6 million students over the past decade—the largest decline in 50 years.

And then there’s some troubling information about the accounting profession’s long hours and lower pay:

- A survey of students by professors at Miami University of Ohio revealed students felt an accounting career requires longer hours and that the day-to-day tasks are less interesting than other business careers. In addition, they perceived an accounting degree to be harder to earn than degrees for some other business majors.

- Research from Burning Glass Institute shows median starting salaries for accounting jobs increased 14% from 2010 to 2021, median starting salaries for data science jumped by 30%, and tech by 40% over the same period.

Alarm Bells at Tennessee Schools

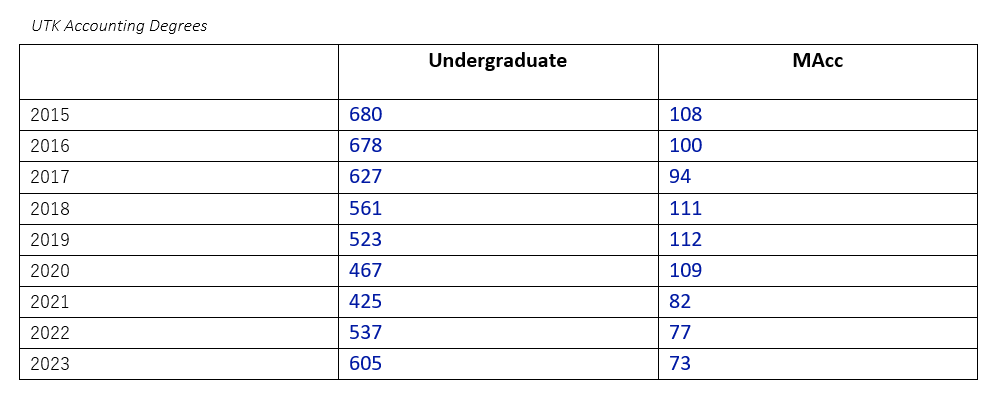

For more than a decade, Dr. Bruce Behn, CPA, dean and CEO, Digital Learning at the University of Tennessee, Knoxville (UTK), has been voicing concern about the school’s trend in accounting majors, which took a dramatic drop after peaking in 2016 but ticked up this year.

At East Tennessee State University (ETSU), Associate Professor Dr. Michelle Freeman, CPA, says the school’s accounting program was robust when she began teaching eight years ago, but the numbers began dropping in 2018 and 2019, with a significant drop during the pandemic. In the last year or so, she says students are returning.

At Christian Brothers University (CBU) in Memphis, Interim Vice President for Academics Dr. Lydia Rosencrants, CPA, CMA, calls the decline “significant.”

CBU Undergraduate Accounting Majors

- 2018: 71

- 2019: 68

- 2020: 47

- 2021: 46

- 2022: 31

The master’s program had 25 students in 2017. By 2022, it had dropped to 14 students. “We’re just not seeing the numbers we used to see,” Rosencrants says, adding that overall, CBU enrollment is down at the undergraduate level but booming at the graduate level.

At Belmont University in Nashville, Dr. Marilyn Young, CPA, professor of accounting, says overall student population numbers held steady during the pandemic, experiencing a slight downward trend at 2% for the fall 2023 semester. “We wondered why it didn’t go up, but we’re not in panic mode,” she says.

Dr. Kim Honaker, CPA, associate professor and interim chair at Middle Tennessee State University, says their accounting programs at the undergraduate and graduate levels have experienced steady declines over the last five to seven years. However, numbers in both programs have trended up for fall 2023, which is welcome news. University administrators expect accounting, as a recession-proof career, to draw strong and stable student numbers year over year, especially considering the high enrollment numbers from the previous decade.

Honaker has tried to educate administrators on the national declines in accounting majors. “Without that background, they assume the decline is specific to our program,” she says. “We’ve been trying to stress that we’re caught at the intersection of general declines in university enrollment and a nationwide trend with respect to accounting. We’re getting whammied from both sides.”

Competition From Within

Young attributes some of the declining enrollments to the number of majors available through business schools today. “When I was a business major, we chose accounting, finance, management, marketing or econ,” she says. “Now business schools are offering 15 majors, so unless you triple your enrollment, you’re going to cannibalize. If you’re quantitatively minded as a freshman, there is so much competition for your interest and talent.”

Rosencrants agrees. “We’re competing with cyber security, data analytics and other careers where this type of student is in demand, and they believe other careers pay better coming out of school or that the job opportunities might be better,” she says.

Accounting’s reputation as a challenging major exacerbates the situation. “Many students are scared off, not just by the challenge of the degree, but the challenges of the profession,” Honaker says. “We have a perception problem.”

Evaluating the Current System

Declining birthrates, impacts of the COVID-19 pandemic and competing professions are all combining to create a complex situation, says TSCPA President/CEO Kara Fitzgerald, CPA, CGMA, CAE. “These things on their own would not have such a significant impact, but together, they are creating the perfect storm for our profession.”

TSCPA has been conducting a firm listening tour, and Fitzgerald says every firm she speaks with needs people and can’t find them.

Inevitably, the 150-hour requirement, and its potential impact on the student pipeline into the profession, is always part of the conversation. TSCPA leadership created a “Statement of Position” on the requirement, which says in part:

TSCPA supports the 150-hour requirement for CPA licensure as currently required in the United States. The CPA profession is facing a critical shortage of individuals pursuing accounting degrees and CPA licensure. However, we do not believe that reducing the requirements for CPA licensure will have a meaningful impact on the CPA pipeline and that the potential risks far outweigh the potential rewards. TSCPA recognizes that the pathway to 150 hours is not a one size fits all, and therefore, we support current efforts to develop various alternatives for students to obtain the additional hours. TSCPA also supports ongoing research and analysis to ensure that as currently structured, the curriculum prescribed achieves the intended goals of preparing CPA candidates to be well-rounded business professionals.

“Most members I’ve spoken to recognize that Tennessee changing the 150-hour requirement alone would not be in our best interest due to the possible impacts to substantial equivalency and mobility,” Fitzgerald says. “There seems to be widespread support for a coordinated strategy to address the talent issues, such as exploring alternative pathways to meet the existing 150-hour requirement and evaluating its effectiveness as currently structured.”

Behn points out that while people are quick to say the 150-hour requirement is a barrier because it’s too costly to get a master’s degree, students still pursue degrees in medicine, law and engineering. “Students choose those majors because they see the value. Those industries aren’t having a problem. If you could track accounting students over their careers and their ROI, that would be an invaluable marketing and branding tool.”

Freeman is adamantly opposed to a push to do away with the 150-hour requirement at a time when the CPA Exam is becoming more rigorous. “It’s insane that these two things are coming at the same time,” she says. Honaker isn’t sure the 150-hour discussion gets to the crux of the problem. “If the market values the additional education, another year’s not that much time in the scheme of things,” she points out. “The issue is that students can make as much, if not more, going into other areas that perhaps aren’t perceived to be as difficult; accounting salaries just aren’t cutting it.”

There isn’t one easy fix or a silver bullet. “Multiple factors got us to this point, and it’s going to take effort from all stakeholders to create meaningful change,” Fitzgerald says. “It will take all of us working together and being open to change. What worked in the past might not work in the future, and we may have to reinvent ourselves to overcome some of the misperceptions that plague our profession.”

National Efforts

The AICPA is taking an aggressive, multi-pronged approach to addressing the pipeline of candidates entering the profession.

CPA Evolution

The AICPA and NASBA are in the process of transforming the CPA licensure model—an initiative called CPA Evolution—to recognize the rapidly changing skills and competencies the practice of accounting requires today and will require in the future.

Starting in 2024, the redesigned CPA Exam places a greater emphasis on technology and analytical skills, as well as on tax, accounting, and audit.

Pipeline Acceleration Plan

In May, the AICPA released an overview of its Pipeline Acceleration Plan to:

Identify ways to integrate the changing needs of new recruits and young professionals

Increase flexibility and accessibility in the licensure pathway

Drive awareness of the wide range of career pathways within the profession in ways that result in a more robust supply of new CPAs

The plan includes 12 short-, mid-, and long-term initiatives, which include addressing accounting firm culture and business model challenges; using positive messaging that can help the profession resonate with today’s high school and college students; and affiliating with colleges and universities to offer internships, scholarships, and other programs to attract students to the profession, help defray costs, and assist them in developing the skills needed to succeed as a CPA.

TSCPA Student Initiatives

According to a Center for Audit Quality report, if the profession wants to attract younger generations, they need to be reached early because two-thirds of accounting students have already chosen their major by the time they reach college.

TSCPA is taking that information to heart, says Megan Williams, who heads up the society’s student initiatives.

One of the most expansive TSCPA programs is Discover Accounting, which brings high school students to college campuses for a day to learn about career options, tour the campus, meet CPAs and take part in interactive activities. TSCPA will hold six events this year and has reached more than 450 high school students so far.

TSCPA also participates in national career awareness campaigns, such as the 2022 AICPA Accounting Opportunities Week, which spread career awareness among high school students. During that event, TSCPA members visited 18 Tennessee high schools. Members also visited elementary schools and read “When I Grow Up I Want to Be… An Accountant” by Dr. Adrian L. Mayse, CPA. In total, members visited with more than 900 students. For 2023, the program has been expanded into Accounting Opportunities Month and takes place in November.

The Count on Success program was held at the Deloitte office in Nashville and partnered with NABA, InRoads and other community organizations to give minority students an opportunity to interact with CPAs, hear their stories, and tour an office. Last year, the program drew 15 students. Next year’s target: 100 students.

TSCPA’s Student Outreach Advancement and Recruitment (SOAR) group is the backbone of the events. Williams says this pool of member volunteers enjoys going out and engaging with students.

“High school students have heard of accounting, but the CPA designation is foreign to them,” Williams says. “They enjoy hearing about the different career paths. We’re doing a lot of work to get in front of students, meet them where they are and raise interest, but we need our members to share their stories. Members are the experts and have the most influence.”

TSCPA also offers a free student membership, which was recently expanded to include high school as well as college students.

Battling for Recruits

Sarah Hardee, CPA, office managing partner for UHY in Nashville, describes today’s recruiting environment as fierce. “It’s a real competition,” she says. “Everyone is looking for people. There just aren’t many accountants looking for jobs.”

Hardee says firms are employing multiple strategies, from drawing people away from their existing jobs to making sure they keep the people they have to getting students committed to internships earlier. Others are relying more on artificial intelligence or turning to offshore labor in India and the Philippines, where a large workforce of accounting professionals who are U.S. CPAs help handle the ever-increasing workload. “One strategy UHY uses is to make sure we don’t lose women from the profession at the height of their careers,” she says. “We focus on this with our WISE program.”

Keith O’Connor, CPA, a vice president at Pugh CPAs in Knoxville, says rather than experiencing a shortage of new graduate recruits, his firm, like other firms, is challenged in retaining its more experienced talent at the three-to-four-year mark. “We’re doing what we can to keep our experienced talent happy.” Moving to a more flexible work environment has helped, but he says the transition from public accounting to private industry still takes place at firms because of “the times of the year with heavier workloads and concerns about competitive enough pay.”

It’s a problem of the profession’s own making, according to Hardee. “Kids today are paying attention,” she says. “They know it’s a lot of hard work to enter the profession. They know they can earn the same or better starting salary in areas like IT and finance, so they’re choosing to bypass majoring in accounting. What we’ve not been good at conveying is the growth and earning potential. We’ve been private about partner salaries and growth potential. Maybe we need to be a little less private about it.”

O’Connor says he feels when recruiting college students, it’s like a coach would be recruiting NCAA athletes: “Start early, stick with them, talk to them throughout high school and create a relationship.”

Even with all the challenges, O’Connor says he’s excited about the future. “Accounting is lucrative, recession-proof, and it’s the language of business. We all need to be talking about that.”

Accounting Departments Reach Out

Accounting departments are taking a cue from firms and getting proactive with their own recruiting strategies to let students know that amazing opportunities await them.

CBU partnered with TSCPA six times last year to bring CPAs into classes and talk about careers. A Discover Accounting day drew 79 students last year and 187 students this year, and Rosencrants says they’re forming partnerships with NABA and Beta Alpha Psi chapters at other schools. “We all realize we need each other. The profession needs students, and it’s not so important where they go but that we inform students of the successful and exciting careers they can have.”

To encourage undergraduate students to stick around and pursue a MAcc, CBU offers a 25% discount on graduate school tuition, which has boosted program numbers.

Because many students come to Belmont for its well-known music business program, Young says the accounting department and its advisory board make a special effort to reach out to strong accounting principles students, sending congratulatory letters to A students. “It might not lead to a degree, but it’s a great networking contact, and it might lead someone to think twice about us,” she says. Those students are then invited to a “Why Major in Accounting” event that includes alumni and firms. “We want to showcase that accounting is worth a look and that we’re doing things differently than other disciplines,” Young explains.

Belmont offers its Summer Accounting Institute to students who already have a non-accounting undergraduate degree but would like to change careers. Designed like a bootcamp, students move quickly through prerequisites and can graduate with a MAcc and be CPA-ready in 15 months. “That program has enhanced our MAcc numbers, so we’re not relying exclusively on traditional accounting undergraduates,” Young says.

Freeman says ETSU’s accounting professors visit every freshman experience course to meet students and present career and salary opportunities. She personally visits audit classes to discuss the master’s program, which has been redesigned to meet the goal of helping students pass the CPA Exam.

ETSU also offers an accounting networking night that drew 32 firms last year. “Students leave with multiple offers,” Freeman says.

What Do We Want To Be?

Of course, the talent pool isn’t just an issue for the accounting profession. “Whatever profession you’re in, you’ve got to be concerned,” Behn points out. “But what do we want to be as a profession? If we take away the educational requirements, we’re moving more toward a vocation rather than being a learned profession.”

Freeman encourages the profession’s leaders to reconsider how they think about the newest generation who are speaking up for themselves, especially on the work-life balance topic. “There’s this mentality that because we worked long hours, this generation is soft because they don’t want that,” she says. “They’re not going to choose our profession if they’re not seen as anything other than robots. Churn and burn is costing us. These kids aren’t afraid of the test. They’re afraid of the profession. Until the profession gets the balance right, it doesn’t matter what we pay.”

Rosencrants believes all of these challenges give rise to innovation and opportunity. “It’s an impetus to reconsider how we’re doing things and asking if we could be doing them better,” she says. “Are there alternative paths to licensure that would be more equitable and inviting to populations that have been excluded from this very good career? I don’t have the answers, but I would surely love to have the conversation.”

For her part, Young has never been more optimistic about the profession than she is right now. “I believe the accounting profession can solve this pipeline problem,” she says. “Educators need the support of members and vice versa. Get on campus. Contact faculty. The more students hear from professionals about this great profession, the more attractive the major becomes. We can’t sit back and wait for them to come to us.”

Watch for part two of this series appearing in the January/February 2024 issue of the Tennessee CPA Journal as we look into the burnout and the emotional, physical and mental toll impacting today’s accounting professionals. Experts weigh in with ideas to help accounting talent become their best personal and professional selves.

About the Author

Natalie Rooney is a freelance writer based in Eagle, Colo. A former vice president of communications for the Ohio Society of CPAs, she has been writing for state CPA societies for more than 20 years.

This article was originally published in the November/December 2023 Tennessee CPA Journal.