By: Emily D. Cokeley, Ph.D., CPA, and Joel Faidley, Ed.D., CMA

Many taxpayers have businesses that they own and manage and seek ways to minimize their tax burden by claiming deductions for business use of their homes. These deductions can offer some tax relief; however, it is important to understand the requirements, limitations, exclusions and other tax implications so they may be properly applied.

Requirements for Deducting Expenses From Business Use of a Home

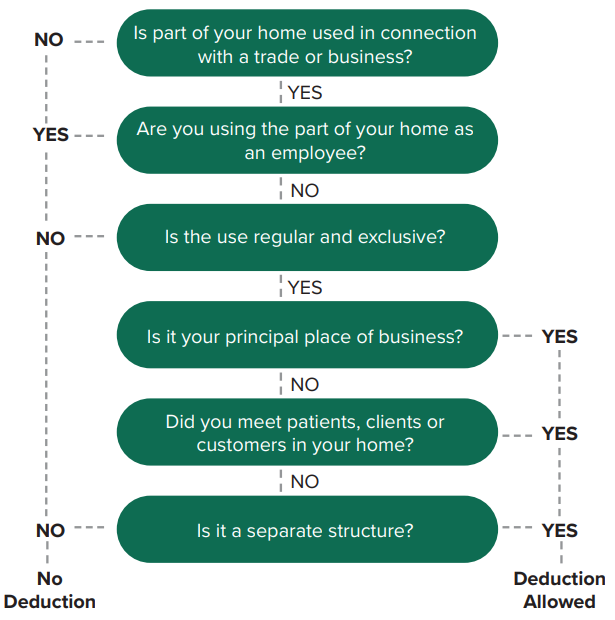

The IRS offers a decision tree (see inset) that makes the requirements for deducting expenses for the business use of a home (home office) clear, and additional details about each of the requirements can be found in this article as well as in IRS Publication 587, “Business Use of Your Home.”1 The first requirement is that the portion of the taxpayer’s home that might be claimed must be used in connection with a trade or business. In this case, “home” includes not just a house or apartment but can also include a recreational vehicle or even a boat, so long as it provides basic living accommodations. To meet the “trade or business” test, the taxpayer must use the designated portion of the home in connection with a trade or business – not just for a profit-seeking activity. For example, using a portion of the home to carry out research on investments for personal gain is not considered a trade or business, but if that portion of the home was used for the same purpose but as the owner of an investment brokerage firm, that portion of the home would qualify as being used in connection with a trade or business, bringing the taxpayer office closer to meeting all requirements for the deduction.

Second, if the taxpayer is an employee (versus an owner) of the business for which the expenses from the business use of the home might be claimed, the home office does not qualify for a deduction. In order to claim the deduction, the claim must be made by an owner of the business, not an employee. As an example, if an employee of a local retailer is asked by the store manager to store goods for resale at his personal residence, that employee may not claim the deduction for business use of his home. The employee is not an owner and wouldn’t file Schedule C for the business and may not claim the deduction on their personal tax return.

Third, the use of the designated space within the home must be both regular and exclusive. “Regular use” necessitates that the space be used for the business purpose more than just occasionally or incidentally, while “exclusive use” mandates the space be used solely for the business purpose. If the space is also used for personal purposes, it does not qualify for the deduction. For example, if a taxpayer regularly uses the dining room in their home as an office from which to conduct business but also uses the dining room to host family meals, the space does not qualify for the deduction. There are two exceptions to the “exclusive use” test, however. If the taxpayer uses the space within the home for the storage of their own business’ inventory or product samples OR if the taxpayer uses a part of the home as a day care facility, the exclusive use test does not have to be met. Additional details regarding these two exclusions can be found in IRS Publication 587.

Assuming the taxpayer has met the three requirements above, any one of the remaining three additional requirements still must be met. In other words, if the part of the home that might be claimed as a deduction for the business use of the home is used regularly and exclusively in connection with a trade or business (and not as an employee of the trade or business), the deduction can be claimed if any of the following three requirements are met:

- The space is the principal place of business.

- The taxpayer meets patients, clients or customers in the home.

- The space is a separate structure.

To be a principal place of business, the space must be used regularly and exclusively for administrative or management activities of the trade or business, and there must be no other fixed location where substantial administrative or management activities for the business are conducted. When considering whether the taxpayer meets patients, clients or customers in the home in the normal course of business, the use of the home must be substantial and integral to the conduct of the business. For example, if an attorney has an office in her home and regularly meets with clients in the home office, it likely meets the requirements for the deduction. Finally, if the taxpayer is claiming a free-standing structure that is separate from the home, it qualifies for the business-use-of-home deduction, so long as the structure is used regularly and exclusively in the course of a trade or business (and not as an employee of the business). Separate structures are not required to be the principal location of the business, nor must the taxpayer meet patients, clients or customers there.

Claiming the Deduction

If it has been determined that the taxpayer qualifies to claim the deduction, there are two available methods to calculate the deduction for business use of the home – using actual expenses or using the simplified method. If opting to use the actual expense method, these costs will need to be classified as direct, indirect or unrelated. Direct expenses are those that are only for the business portion of the home and are fully deductible. Indirect expenses are those for the upkeep and running of the entire home and will need to be allocated between deductible and non deductible based on the percentage of the home used for business. Unrelated expenses are those that are for the non-business portion of the home only, and no portion of these expenses is deductible.

Expenses that could be claimed on Schedule A: Itemized Deductions, such as real estate taxes, home mortgage interest, and casualty losses attributable to a federally declared tax disaster, may be deducted on a pro rata basis as part of the home office deduction to the extent that they would have been deductible as an itemized deduction on Schedule A. However, if the taxpayer is claiming the standard deduction instead of itemizing, these items would be deductible only to the extent that they would have increased the standard deduction had the taxpayer not used the home for business. Since real estate taxes and home mortgage interest don’t increase the standard deduction, they would not be used in the calculation of the business-use-of-home deduction, although under new rules, certain casualty losses attributable to a federally declared disaster can increase the standard deduction and can therefore be used to calculate the deduction.

Calculating the Deduction

To calculate the business-use percentage of the home, two methods are allowed:

- Divide the qualified area used for business by the total area of the home.

- Divide the number of qualified rooms used for business by the total number of rooms in the home when all the rooms in the home are about the same size.

Area is calculated as length times width of the space and should be reported in square feet. If the home office is 300 square feet and the total area of the home is 3,000 square feet, the business-use percentage would be 10%. Alternatively, if two rooms in the home are used for business and the home has eight near-equal-sized rooms, the business percentage would be 25%. This business percentage is used for allocating indirect expenses between business use (deductible) and personal use (non deductible) of the home.

Limitations and Other Considerations

Using the simplified method requires significantly less work than the actual expenses method, resulting in less time and effort spent on calculating, allocating and substantiating the actual expenses that make up the amount of the deduction. The calculation of the deduction using the simplified method only requires that the area of the home used for business be multiplied by $5, up to a maximum of 300 square feet (or $1,500).

While a taxpayer is likely looking to maximize his or her deductions, there is a limit to how much can be claimed, whether using the simplified method ($1,500) or the actual expenses. If using the actual expenses, and gross income from the business exceeds total business expenses, all of the business expenses related to the business use of the home may be deducted. However, if gross income from the business is less than total business expenses, the deduction for expenses for the business use of the home is limited – The deduction will be capped at the gross income from the business less the total of:

- The business portion of expenses that could be deductible if itemizing deductions on Schedule A or net qualified disaster losses if claiming the standard deduction.

- The direct business expenses related to the business activity in the home (see examples of direct expenses above).

Form 8829 will assist in the calculation of deduction limits for Schedule C filers, while the worksheet included within IRS Publication 587 will assist in the calculation of deduction limits for Schedule F filers as well as partners of a business.

When taking the deduction for the business use of a home, taxpayers using Schedule C should report the deduction on Line 30 of Schedule C, while taxpayers using Schedule F should report the deduction on Line 32 of Schedule F, both entering “Business Use of Home” on the dotted line beside the deduction amount. Records that support the amounts used in the calculation of the deduction (utility bills, for example) should be maintained by the taxpayer in the event that they are requested by the IRS. The documentation should include a description of the part of the home used for business and that the area has been used regularly and exclusively for business, with additional information to show that it is also the principal place of business, the place where the taxpayers meet with clients, patients, or customers, or that it is a separate, freestanding structure from the home. As with all tax records, this documentation should be retained for the longer of three years from the due date or filing date of the return or two years after the tax was paid.

A potential pitfall that may discourage a taxpayer from claiming a business-use of-home deduction is the future sale of the property. Capital gains from the sale of the home may be taxable for the business percentage identified on past tax returns, even if the $250,000 ($500,000) exemption is available for single (married) taxpayers. Assuming the taxpayer meets the requirements for exclusion of the gain on sale, the taxability of the gain on sale of the business portion of the home depends next on whether the home office portion of the home is part of the home or freestanding. If the home office is part of the home, no allocation of the gain on sale needs to be completed between the business-use portion of the home and the rest of the home – The entire $250,000 ($500,000) exclusion applies without restriction. If the home office is a structure separate from the home, the taxpayer may not exclude the gain on sale of the home office portion of the home property – unless the taxpayer owned and lived in that structure for at least two of the five years that ended on the date of the sale. In that case, the gain on the sale would be excluded for the structure, up to the exclusion limit.

As an example: An unmarried taxpayer sells his principal residence for $350,000 and has a basis of $100,000. He used a room in his home, which equals 10% of the home’s total square footage, as a deductible home office. The taxpayer is allowed to exclude the full $250,000 gain on the sale of his home since he meets the applicable gain on sale exclusion tests, and he does not have to allocate a portion of the gain on sale to the home office portion of the sale. If instead the taxpayer used his pool house (a separate structure from his home but still on the grounds of his home) as his home office, he would need to allocate a portion of the gain on sale of the property to the pool house. That portion would not be excluded from the gain on sale, assuming the taxpayer did not live in the pool house for any two of the five years preceding the sale.

Conclusion

Determining the deductibility and calculating the deductible portion of expenses related to the business use of a home can be a complicated process, and due care should be taken to properly assess whether the taxpayer meets the requirements of the deduction. Additional rules for in-home day cares, depreciation, business furniture and equipment, and even more topics are also included within IRS Publication 587, and taxpayers and tax preparers should consult this document for any additional details and information when determining the calculation and deductibility of expenses for the business use of a home.

About the Authors

Emily D. Cokeley, Ph.D., CPA, is an assistant professor at East Tennessee State University. She can be reached at cokeley@etsu.edu.

Joel Faidley, Ed.D., CMA, is the chair of accountancy and a professor of practice at East Tennessee State University. He can be reached at faidley@etsu.edu.

References

1Internal Revenue Service. (2024, December 16). Publication 587: Business Use of Your Home.

This article was originally published in the May/June 2025 Tennessee CPA Journal.