By: Dr. Amelia Hart, CPA, and Steve Sledge, CPA

The Financial Accounting Standards Board (FASB) has several proposed Accounting Standards Updates (ASUs) at various phases of the process. This article addresses two proposed ASUs that are expected to be finalized soon. One relates to compensation, and the other relates to convertible debt instruments. Building on the recent article on finalized ASUs, this article summarizes the proposed changes in the Scope Application of Profits Interest Awards: Compensation—Stock Compensation (Topic 718)1 and Debt—Debt with Conversion and Other Options (Subtopic 470-20): Induced Conversions of Convertible Debt Instruments2 exposure drafts. These summaries are intended to provide a high-level overview. Please consult the complete FASB project updates for consideration of specific circumstances that may affect you or a client in advance of the pending final issuance or for any revisions.

Scope Application of Profits Interest Awards: Compensation—Stock Compensation (Topic 718)

The FASB released guidance on this topic following an agenda request submitted in October 2018. The scope issue and other related issues were discussed with the Private Company Council (PCC) and the PCC Technical Agenda Consultation Group at various meetings, along with staff research and outreach that was conducted by the FASB staff on the scope issue.

In its April 2022 meeting, the PCC recommended that the FASB add a project to its technical agenda to address the scope of guidance applicable to profits interest awards.

The project was added to the technical agenda in December 2022 with the purpose of addressing stakeholder concerns by adding illustrative examples that demonstrate the application of the guidance. In May 2023, the proposed Accounting Standards Update (ASU) was issued to address whether profits interest awards represent (a) share-based payment arrangements within the scope of Accounting Standards Codification (ASC) 718 or are more like (b) a cash bonus or profit-sharing arrangement within the scope of ASC 710.

The existing guidance in ASC paragraph 718-10-15-3 states that ASC 718 applies to all share-based payment transactions in which a grantor acquires goods or services to be used in operations or provides consideration payable to a customer by:

a. issuing shares, share options or other equity instruments or by

b. incurring a liability to an employee or non-employee that

- is based, at least in part, on the entity’s shares or other equity instruments or

- may require settlement by issuing the entity’s equity shares or other equity instruments.

To provide additional interpretive guidance, the proposed ASU (i.e., the exposure draft) provides illustrative examples on whether a profits interest award is within the scope of ASC 718 or not. That’s it basically – what is “in” and what is “out.”

After consideration of comments received on the proposal through the comment period, the FASB indicated that the final ASU is expected to include expanded illustrative examples and confirmed that the final ASU would apply to public business entities (PBEs) and non-PBEs and to awards to both employees and non-employees.

The FASB has determined that the updates in this proposal will be effective for PBEs for fiscal years beginning after Dec. 15, 2024, and interim periods within those fiscal years, whereas for non-PBEs, the proposal would become effective for fiscal years beginning after Dec. 15, 2025, and interim periods within those fiscal years. Early adoption would be permitted.

The final ASU is expected to be issued in the first quarter of 2024. Readers should review any profits interest arrangements and the clarifications provided by this proposed (and expected final) ASU, once issued, to consider any potential impact.

Induced Conversions on Convertible Debt Instruments (EITF Issue No. 23-A)

The FASB added the topic of induced conversions on convertible debt instruments in response to a November 2022 agenda request by the Big Four public accounting firms. The firms asked for the Emerging Issues Task Force (EITF) to address certain issues related to the settlement of convertible debt instruments that became amplified after the adoption of ASU 2020-06, Debt with Conversion and Other Options (Subtopic 470-20) and Contract in Entity’s Own Equity (Subtopic 815-40). In September 2023, the EITF reached a consensus-for-exposure on Issue 23-A. The consensus-for-exposure was ratified by the board in October 2023, and the FASB subsequently issued a proposed ASU entitled Debt—Debt with Conversion and Other Options (Subtopic 470-20): Induced Conversions of Convertible Debt Instruments in December 2023, which applies to entities that settle certain convertible debt instruments with cash conversion features (CCFs).3

Convertible instruments with CCFs generally provide the issuer with optionality to settle the conversion of the instrument in cash, shares or a combination thereof, based upon the conversion value. The issuance of ASU 2020-06 eliminated a separate accounting model for certain settlements of convertible debt instruments with CCFs. With the elimination of this separate accounting model, there is a more significant accounting difference when applying induced conversion accounting versus extinguishment accounting to the settlement of a cash convertible instrument. In certain settlements, it is not always clear which accounting model is appropriate to apply.

Induced conversion accounting applies to the conversion of convertible debt instruments pursuant to terms that differ from the original conversion terms of the instrument. The proposed ASU introduces a preexisting contract approach, which requires companies to assess the form (i.e., cash and/or shares) and amount of consideration provided to the instrument holder compared to what the holder was entitled to receive under the preexisting conversion privileges based on the fair value of the entity’s shares as of the inducement offer acceptance date. To qualify for induced conversion accounting under this approach, the inducement offer must preserve the form of consideration and result in an amount of consideration that is no less than that issuable per the preexisting conversion privileges. The proposed ASU also clarifies that induced conversion accounting can be applied to settlements of certain convertible debt instruments that are not (or not yet) currently convertible because, for example, the conversion date is in the future or a contingency has not yet passed.

Entities with convertible debt instruments with CCFs outstanding should consider how in-process or anticipated settlement negotiations with holders may be affected. Entities should also consider the proposed transition policy elections if they had any settlements of convertible debt with CCFs after the adoption of ASU 2020-06 that would be subject to transition disclosures.

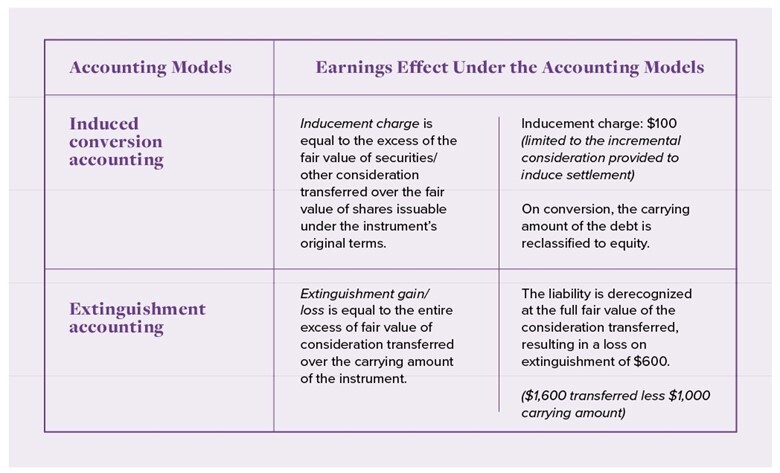

The following table is an excerpt from the proposed ASU illustrating the difference in earnings effect between induced conversion accounting and extinguishment accounting,4 which indicates the potential magnitude of the earnings’ difference between induced conversion versus extinguishment accounting.

- ABC Corp has convertible debt outstanding with a $1,000 net carrying amount. The if-converted value of the debt is $1,500.

- ABC Corp settles the instrument in a transaction in which $100 of additional consideration is provided to the holder.

The proposed ASU also clarifies certain criteria, such as the assessment of preexisting and modified conversion privileges is performed as of the offer acceptance date and that if the convertible instrument was modified within a one-year period preceding the offer acceptance date, the evaluation of the form and amount of consideration test would be based on the conversion privileges in effect immediately prior to the modification of the instrument.

Regarding transition and transition disclosures, the proposed ASU requires prospective application to convertible debt instruments settled after the effective date of the ASU. Retrospective application to instruments settled after the adoption of the amendments in ASU 2020-06 is permitted but not required. Entities can choose to disclose the nature and reason for the change in accounting principle if they elect to apply the amendments prospectively. If they elect to adopt the changes retrospectively, they must disclose the nature of the change, the method of applying the change, the cumulative effect on retained earnings or other components of equity, and the effect on income from continuing operations and other financial statement line items.

The FASB comment period on this proposed ASU will remain open through March 18, 2024. Readers are encouraged to evaluate the impact of this proposed update and to periodically review the most recent updates on the project.5

About the Authors

Dr. Amelia Hart, CPA, serves on the faculty of the Haslam College of Business in the Department of Accounting and Information Management at the University of Tennessee, Knoxville. She can be reached at ihart@utk.edu.

Steve Sledge, CPA, is a partner at KPMG LLP in Nashville. He can be reached at ssledge@kpmg.com.

References

1 Scope Application of Profits Interest Awards Compensation-Stock Compensation (Topic 718) is retrievable at https://bit.ly/fasb718

2 Induced Conversions of Convertible Debt Instruments (EITF Issue No. 23-A) is retrievable at https://bit.ly/eitf23a

3 The full text of the proposed ASU is retrievable at https://bit.ly/fasbdebt

4 Induced conversion accounting involves an inducement charge equal to the excess of the fair value of securities or other consideration transferred over the fair value of shares issuable under the instrument’s original terms. On the other hand, extinguishment accounting involves an extinguishment gain or loss equal to the entire excess of the fair value of consideration transferred over the carrying amount of the instrument.

5 Project Update on the proposed ASU, Debt—Debt with Conversion and Other Options (Subtopic 470-20): Induced Conversions of Convertible Debt Instruments at https://bit.ly/fasbprojecthistory

This article was originally published in the March/April 2024 Tennessee CPA Journal.