By: Dr. Amelia Hart, CPA, and Steve Sledge, CPA

Turning the Page to the FASB’s Next Chapter

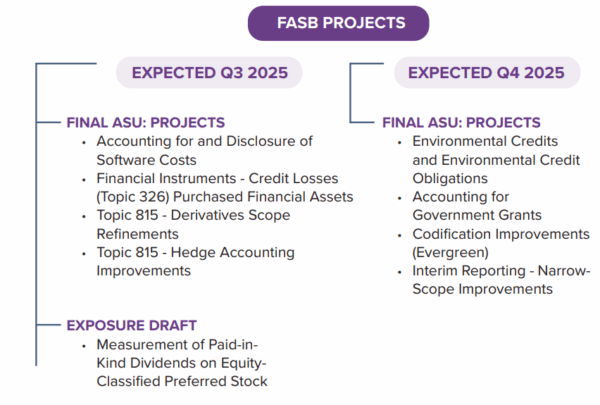

The Financial Accounting Standards Board (FASB) is looking ahead to what is next as many of its current projects are near the Final Accounting Standards Update (ASU) milestone. Seven proposed updates are projected to be finalized by Dec. 31, 2025. If completed as scheduled, the FASB will have only one exposure draft, two projects under board redeliberations, and one project under initial deliberation remaining on the technical agenda.1

In addition, further changes are expected as three of seven board members, including the chair, Richard Jones, complete their terms of service within the next two years. These transitions could bring shifts not only in the composition but also in the culture, approach and strategic direction of the board moving forward.

Charting What’s Next on the FASB Agenda

In light of the progress and accomplishments reflected in the technical agenda that largely prioritized stakeholder feedback from the 2021 Agenda Consultation, the FASB is now shifting its attention to research and information gathering to determine its future focus. To support this effort, the FASB has issued several invitations to comment to gather stakeholder input and explore key issues. The Agenda Consultation Invitation to Comment (ITC) was issued on Jan. 3, 2025, with comments due June 30, 2025.

The ITC feedback will help the FASB prioritize its future standard-setting agenda. Additionally, the FASB sought feedback on two other topics: Financial Key Performance Indicators (KPIs) for Business Entities and Accounting for and Disclosures of Intangibles. KPIs are measures calculated or derived from financial statements but are not presented in U.S. GAAP financial statements. The FASB sought stakeholder input on issues such as whether KPIs should be standardized, which KPIs should be included if so, and whether KPIs should be disclosed in the financial statements. The ITC on Intangibles aimed to gather feedback on the perceived need for additional or new accounting guidance on capitalization of intangible assets, particularly with respect to internally developed versus acquired intangibles. Stakeholder feedback from these ITCs will guide future standard-setting priorities.

As of Aug. 1, 2025, the FASB Research Agenda included eight topics, including the aforementioned items, i.e., the Agenda Consultation, KPIs, and Intangibles. The remaining research projects cover accounting for commodities, accounting for derivatives, consolidation for business entities, hedge accounting, and the statement of cash flows.

For authoritative, real-time updates, refer to FASB's website: https://www.fasb.org. This article is intended to provide a summarized status update and should not replace verification of information in the actual ASUs and related standards.

Next in Line! ASUs Approaching Final Stage Milestone

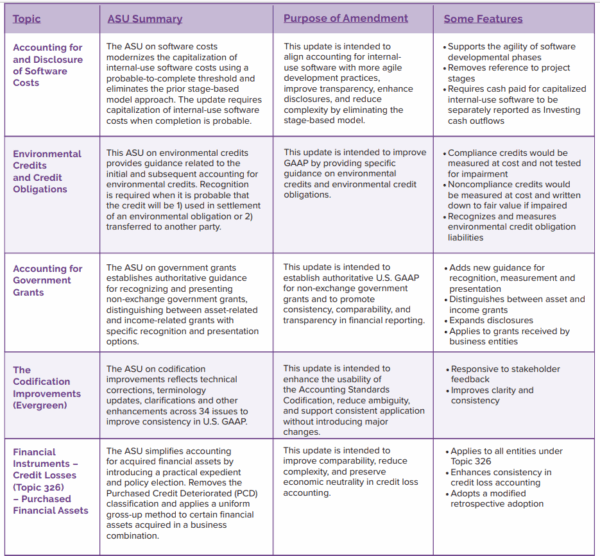

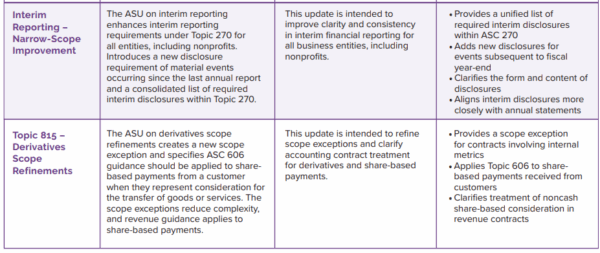

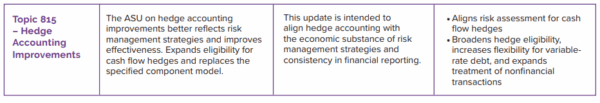

The FASB has seven proposed ASUs, with final ASUs as the next milestone. These seven ASUs, expected to be completed by year-end, will complete a significant portion of the technical agenda projects. The expected final updates will include guidance on software costs, government grants, credit losses, interim reporting, derivatives, hedge accounting, and certain codification improvements. Below is a high-level overview of what is expected under each topic in the final ASUs.

As the FASB nears completion of several important ASUs, conducts research on what’s next on its agenda and prepares for leadership changes, we are at an inflection point. The coming years will shape not just the board’s agenda but also the broader impact on financial reporting. A new chapter is about to begin!

Reminder: Users should consult the actual ASUs for complete insights and developments within the FASB.

About the Authors

Dr. Amelia Hart, CPA, serves on the faculty of the Haslam College of Business in the Department of Accounting and Information Management at the University of Tennessee, Knoxville. She can be reached at ihart@utk.edu.

Steve Sledge, CPA, is an audit partner at Frazier & Deeter Advisory LLC. He can be reached at steve.sledge@frazierdeeter.com.

References

1This information reflects the Technical Agenda as of August 1, 2025. Please note that the FASB Technical Agenda is updated as projects reach milestones or as new projects are added. The most current version of the Technical Agenda can be accessed at https://bit.ly/fasbtechagenda.

This article was originally published in the September/October 2025 Tennessee CPA Journal.