By: Beth Howard, Ph.D., CPA

Insufficient retirement savings is a dilemma facing a significant portion of American families, particularly lower- and middle-income families. Many of these individuals are not covered by employer-sponsored retirement plans and are not likely to contribute to Individual Retirement Accounts (IRAs). The saver’s tax credit is intended to encourage these individuals to begin contributing to these retirement savings plans.

What Is the Saver’s Tax Credit?

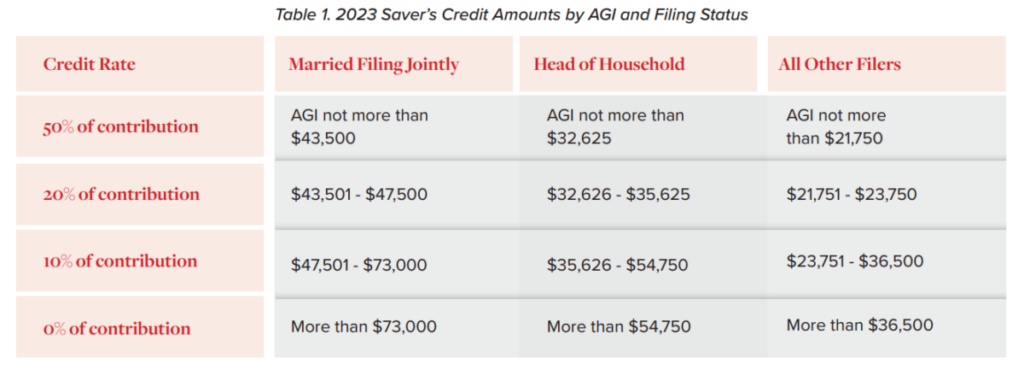

The retirement savings contribution credit, known as the “saver’s credit,” was enacted in 2001 as part of the Economic Growth and Tax Relief Reconciliation Act (EGTRRA) as a way to encourage individuals to save for retirement. The saver’s credit is a non-refundable tax credit that gives a credit of up to 50% to those taxpayers contributing to employer-sponsored retirement plans, Achieving a Better Life Experience (ABLE) plans, or traditional or Roth IRAs. The credit is available to taxpayers who are 18 or older, who are not claimed as a dependent on another person’s tax return, and who are not full-time students. The saver’s credit equals 50%, 20% or 10% of eligible retirement contributions of up to $2,000 ($4,000 for those who are married filing jointly), depending on the taxpayer’s AGI.1 The credit can be claimed for any contributions made for the tax year, which includes IRA contributions made until the due date for the tax return (April 15, 2024, for 2023 contributions). See Table 1 for the credit rates by AGI and filing status for 2023.2

Utilization of the Credit by Taxpayers: How Does Tennessee Compare?

The saver’s credit has been available now for more than 20 years, but it is not used by a large number of taxpayers who would qualify for it. Data from the IRS Statistics of Income (SOI) for the most recent 10 years for which data was available (2010-2019)3 was used to analyze the usage of the tax credit in the U.S. as a whole, by region and by state. While there are some limitations to the data available, it can give a general idea of the utilization of the credit by taxpayers as well as how that utilization has changed over time.

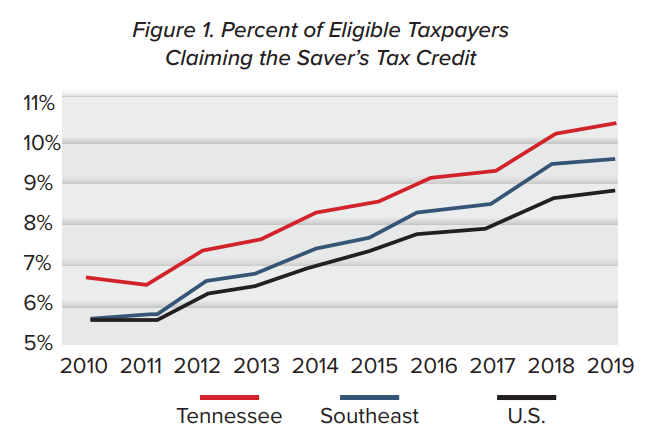

Based on the available data, utilization of the saver’s credit has increased somewhat over time but remains extremely low, with approximately 8.7% of potentially eligible taxpayers in the U.S. claiming the credit in 2019, up from only 5.5% claiming the credit in 2010. The utilization of the credit is slightly higher in Tennessee, with 10.4% of potentially eligible taxpayers claiming the credit in 2019, up from 6.7% who claimed the credit in 2010. Comparing utilization of the credit on a state-by-state basis, Tennessee fares well. In the earlier years examined (2010-2017), Tennessee ranked between 15th and 17th in the percentage of potentially eligible taxpayers who claimed the credit. In 2018 and 2019, Tennessee had the 10th highest percentage of potentially eligible taxpayers using the credit. Notably, these two years saw an increase to over 10% of potentially eligible taxpayers claiming the credit in Tennessee. See Figure 1 for the percentage of potentially eligible taxpayers claiming the saver’s credit each year for the U.S., the Southeast region and Tennessee.

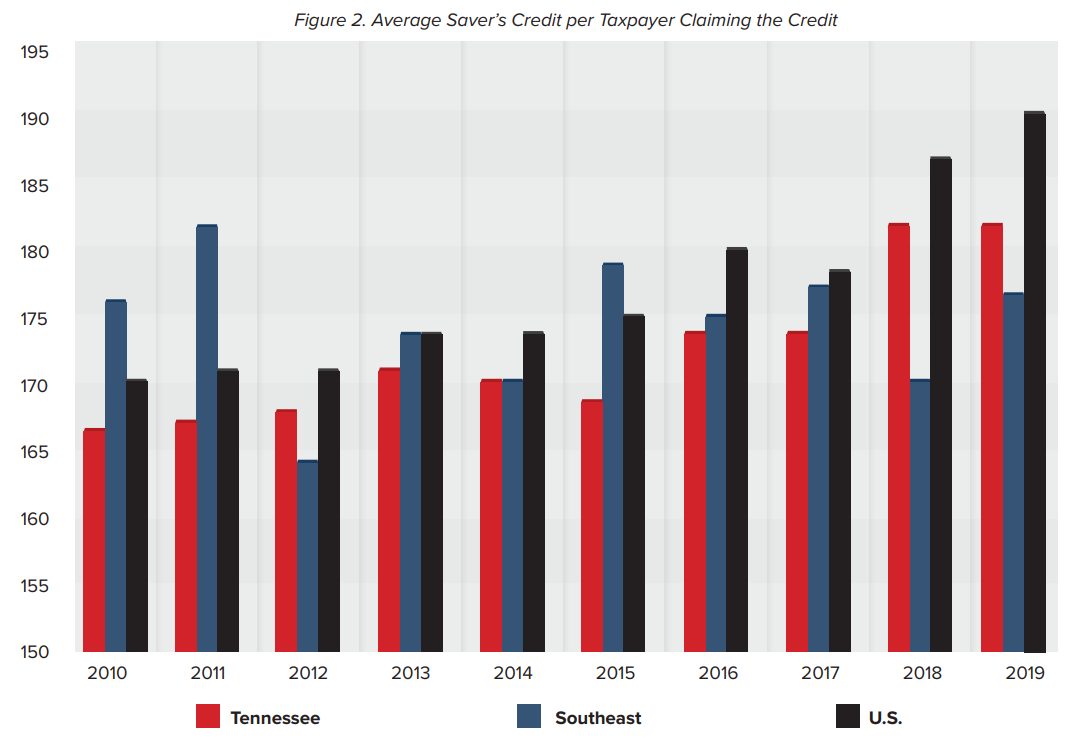

Among taxpayers who claim the saver’s credit, the amount of the credit claimed per taxpayer has increased slightly during the years examined, with an average credit claimed per taxpayer of $169.56 in the U.S. in 2010 and an average credit claimed per taxpayer of $189.74 in 2019. While the percentage of eligible taxpayers claiming the credit in Tennessee exceeded the percentage of eligible taxpayers claiming the credit in the U.S. throughout the time examined, the amount of the credit claimed per taxpayer was consistently lower in Tennessee than in the U.S. as a whole. The average saver’s credit claimed per taxpayer in Tennessee ranged from a low of $166.12 in 2010 to a high of $187.49 in 2019.

See Figure 2 for the average amount of saver’s credit claimed per taxpayer claiming the credit each year for the U.S., the Southeast region and Tennessee.

Issues Preventing Higher Utilization of the Credit

Data indicates that the saver’s credit is not utilized as much as it could be, and several studies have examined reasons for this underutilization. Reasons for this underutilization include lack of awareness of the credit, lack of cash available to make the contribution and the nonrefundable structure of the credit.

According to the 23rd annual Transamerica Retirement Survey, less than half (49%) of U.S. workers know about the saver’s credit.4 Further, among households with income less than $50,000, only 42% were aware of the credit.

These figures indicate that one issue preventing some taxpayers from claiming the credit is a lack of awareness. Notably, studies have shown that eligible taxpayers who use a professional tax preparer or tax software to prepare their tax return are much more likely to claim the credit.5

Taxpayers who would qualify for the saver’s credit may also lack the ability to contribute to retirement plans because they do not have the cash available to do so, particularly if those individuals were unaware of the credit and unable to plan for the contribution before filing their tax return. Many taxpayers have already made plans for how they will use their tax refunds before they file their tax returns, and they have no room left for contributing to a retirement account if they learn that such a contribution would allow them to benefit from the saver’s credit.6 Many of the taxpayers who would benefit from the saver’s credit may also be living paycheck to paycheck and feel that putting money into an investment account that must remain invested until retirement (or age 59½) is not feasible even if they do have the cash available for the moment. This further decreases the likelihood that taxpayers will choose to utilize the saver’s credit.

Another issue that prevents many taxpayers from taking advantage of the saver’s credit is its structure as a nonrefundable tax credit. Because the credit is aimed at taxpayers with relatively low incomes, many of the taxpayers who could benefit from the highest credit percentage have little to no tax liability. This limits the usefulness of the credit. As noted earlier, the average amount of the saver’s credit claimed per taxpayer in 2019 was $189.74 for the U.S., with an average of $187.49 for Tennessee.

How the SECURE 2.0 Act Can Increase Utilization of the Saver’s Credit

The SECURE 2.0 Act of 2022 was passed in December of 2022 and was meant to improve retirement savings by encouraging more employers to offer retirement plan benefits and more employees to participate in retirement savings plans. Beginning in 2025, employers with more than 10 employees who offer a new 401(k) or 403(b) plan must automatically enroll new employees in the plan.7 While employees may opt out of the plan, automatic enrollment will likely increase the number of individuals contributing to retirement plans. To the extent that these individuals are eligible for the saver’s credit, automatic enrollment should increase the utilization of the saver’s credit as well.

Beginning in 2024, the SECURE 2.0 Act allows individuals participating in an employer-sponsored retirement plan to make penalty-free emergency withdrawals for unforeseeable or immediate family needs related to necessary personal or family emergency expenses. Employees can withdraw up to $1,000 once every three years or once per year if the distribution is repaid to the plan within three years. The ability to withdraw some funds penalty-free could serve to encourage taxpayers who could benefit from the saver’s credit to participate in a retirement savings account and, thus, utilize the credit as well.

The SECURE 2.0 Act requires employers to allow long-term, part-time workers to participate in the employer’s 401(k) plan. Part-time employees with two consecutive years of service of at least 500 hours per year can participate in the retirement plan. To the extent that this serves to increase retirement plan contributions among part-time employees, it will also likely increase the number of saver’s credit-eligible taxpayers who utilize it.

The SECURE 2.0 Act also addresses the saver’s credit directly by replacing the credit with a federal matching contribution that will be deposited into the taxpayer’s IRA or retirement plan beginning in 2027. The match will be equal to 50% of the taxpayer’s IRA or retirement plan contributions of up to $2,000 per individual. The match will phase out for taxpayers who are married filing jointly and have adjusted gross incomes between $41,000 and $71,000 ($20,500 and $35,500 for those who are single or married filing separately; $30,750 and $53,250 for those who are head of household). Changing the nonrefundable credit to a matching contribution will allow taxpayers with no tax liability to still access the benefits of the incentive. The law also aims to increase the awareness of the new saver’s match by directing the Treasury Department to promote the program, which should help improve public awareness of the program’s availability.

Conclusion

Many families in the U.S. currently have insufficient retirement savings, and this issue is particularly acute among lower- and middle-income families. While the saver’s credit was intended to address this problem by encouraging such individuals to contribute to retirement savings plans, it has not proven to be effective in increasing such savings. Several reasons have been studied for the lack of utilization of the saver’s credit, including lack of awareness, lack of cash to contribute to a retirement plan, and the nonrefundable structure of the tax credit. The SECURE 2.0 Act looks to improve retirement savings by encouraging more employers to offer retirement plans and more employees to participate in those plans. As more employees begin to participate in employer-sponsored retirement plans, those who would be eligible for the saver’s credit can also make use of the credit when they file their tax return. Further, beginning in 2027, the saver’s credit will be replaced with a saver’s match that will eliminate the issue related to the current credit’s nonrefundable structure.

About the Author

Dr. Beth Howard, CPA, is an associate professor in the Department of Accounting at Tennessee Technological University. She teaches taxation in both the undergraduate accounting and MAcc programs at Tech and also teaches technology for accountants and financial accounting. She can be reached at bethhoward@tntech.edu.

References

1 IRC §25B

2 https://bit.ly/irssavers

3 https://bit.ly/irssoi

4 https://bit.ly/transamericasavers

5 Koenig, Gary and Robert Harvey. “Utilization of the Saver’s Credit: An Analysis of the First Year.” National Tax Journal 58 No. 4 (December 2005): 787 – 806.

6 Duflo, Esther, William Gale, Jeffrey Liebman, Peter Orszag, and Emmanuel Saez. “Savings Incentives for Low- and Moderate-Income Families in the United States: Why is the Saver’s Credit Not More Effective?” Journal of the European Economic Association 5 No. 2/3 (April – May 2007): 647 – 661.

7 https://bit.ly/secure2summary

This article was originally published in the January/February 2025 Tennessee CPA Journal.