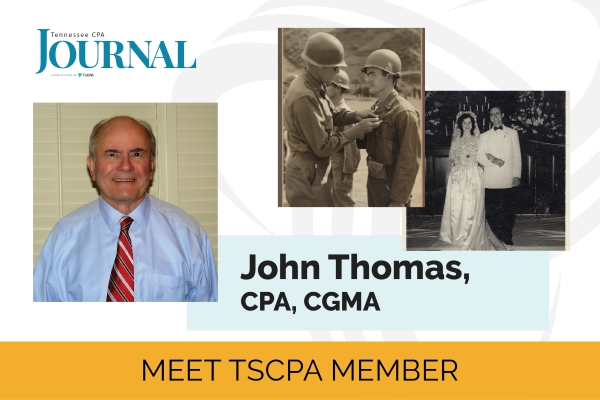

Meet TSCPA Member: John Thomas, CPA, CGMA

Few TSCPA members can say they had their first exposure to the accounting profession during the years of World War II. But for John Thomas, CPA, CGMA, that was the case. “With both of my parents’ knowledge as bookkeepers, they formed the accounting firm of J.W. Thomas & Company, first located in a nice building next to our home garage,” he recalls. “Since this was before computers, they had only one metal adding machine. But due to World War II, most metal was being used for weapons production, causing a supply shortage. Since an extra machine wasn’t available, I became their human adding machine. When I came home from school, they had columns of figures for me to add. This, I suppose, was my first encounter in the accounting world.” Today, Thomas is still active in the profession, as he maintains his solo practice from home. He says, “After being in the accounting field for the last 78 years, it is still one of the leading professions for anyone to pursue!”

Memphis Native

I am a Memphian, 93 years old, born in May 1929 at the Baptist Hospital and have lived here all my life. I was a Depression baby, before TVs, cell phones, computers, CPE, peer review, etc., but we did have a “party-line” phone. My mom and dad had good jobs, and I remember people coming to the house selling apples just to make ends meet. We were members of a Southern Baptist church, and I have remained in that denomination to this day. I played all the different yard games – tag, baseball, hide and seek, kick the can, biking, roller skating – while growing up in our neighborhood on Broad Street, a little east of Overton Park … During high school, I worked for my parents and became a Public Accountant like my parents (a second classification in Tennessee that no longer exists).

Early Goals

My education in high school was heavy in mathematics since, at that time, I wanted to become a civil engineer. As a teenager, I worked two summers at Memphis Light, Gas & Water (MLGW) and learned to operate the rod and chain, and later the transit, to compute all the different locations of gas equipment. I made plans to attend an engineering college in Kentucky, but I just couldn’t leave my girlfriend, who I had been dating for a couple of years. We married and I continued my studies at Rhodes College while working in the accounting business.

Purple Heart Recipient

At the end of my second year in college, my local Tennessee National Guard unit was activated. I was sent to Colorado for three months of training and on to the Korean War. My unit was the 196th Field Artillery Battalion and served from Aug. 19, 1950, to April 7, 1952, and I was appointed as chief of survey. My experience at MLGW reflected my abilities to manage the transit and compute the exact locations to place the big guns to fire on the enemies. I was awarded the Purple Heart after being wounded by shrapnel. I was sent to Tokyo for a month of healing; then, I was sent back to Korea to later rotate to the U.S. to be honorably discharged from the army and meet my first-born son, who was now a year old.

Road to CPA

After returning home, I began to work for my parents’ company and became the manager of the firm. Dad wanted me to work instead of going back to college. In 1955, my parents sold their firm to a local CPA, Bill Frazee, and I went with the deal. Bill said that if all went well after a year, I could be his partner. A year passed, and I became a partner with Frazee and Thomas. But that didn’t last long, since the Tennessee Board of Accountancy declared Bill couldn’t be a partner with a non-CPA. I wanted both things and acted. It was a celebratory day when I was awarded my Tennessee CPA certificate on Feb. 5, 1960.

Career Highlights

My career has brought me many opportunities of specialties in accounting, taking me to many states and other countries to perform hotel auditing procedures to confirm their financial statuses. Some highlights are opening a branch office in West Palm Beach, Fla., to continue auditing for years a hotel client that moved there, meeting with the SEC’s head of accounting to argue a construction client’s desire to treat certain costs in a certain manner, traveling several times to Munich, Germany to review the accountant’s work on my client’s new Holiday Inns being built in Germany, working with a national CPA firm’s local office concerning my client listed on the American Stock Exchange, being engaged as the lead audit partner for auditing Shelby County’s financial operations for 12 years, testifying in courts as an expert witness, and working for years with the best accountants and support staff that any firm would envy. I have served over the years on several TSCPA Memphis committees and was president of the Memphis Chapter during 1972-73.

Changes in the Profession

A lot has changed. The two major changes I’ve seen are automation, then complexity of business transactions. FT&T was the second firm in Memphis to install an IBM punch card system and progressed to the major upgrades in data processing. From my early days with JWT, businesses were simple to understand, and the tax laws were also fairly simple. Now there are many more complex issues that CPAs have to be aware of and understand. This will continue for years to come.

Family Life

At the age of 30, I was working, had a wife and four children, and passed the CPA exam. With those wonderful three sons and one daughter, I now have 11 grandchildren and five great grandchildren, with three more coming soon. I was married to my lovely wife Delores for 64 ½ years after dating two-and-a-half years. We grew up together, and she went to heaven in December 2016.

Staying Active

I try to keep in physical shape by working out at a gym, playing golf once a week and still driving my car. I currently lead the song service for my Bible class each Sunday, am an active deacon at my church and enjoy traveling in the U.S. I was a tenor soloist and choir member and sang duets with my daughter.

This article was originally published in the November/December 2022 Tennessee CPA Journal.