Bridging the Gap: New CPA Licensure Legislation To Address the CPA Shortage

TSCPA has stayed at the forefront of the national discussions related to talent shortages and the factors contributing to the decreasing number of accounting professionals across the U.S. Last fall, Chair Kelly Crow appointed the Human Capital Strategy Task Force. This 10-member task force was charged with studying and developing recommendations on how TSCPA should respond to what is often referred to as the profession’s pipeline challenges. Specifically, the task force:

- Reviewed and discussed the time and cost of education and the related impacts to the profession.

- Evaluated options that would drive positive impacts to the accounting workforce in Tennessee while protecting the public interest.

- Reviewed and drafted responses to two Exposure Drafts – The CPA Competency-Based Experience Pathway Exposure Draft and the Proposed Amendments to the Uniform Accountancy Act (UAA) Section 5 and UAA Model Rules Article 3. TSCPA formally submitted comment letters in response to the two exposure drafts.

The task force studied and discussed the National Pipeline Advisory Group (NPAG) findings, reviewed Tennessee licensing statistics, and gained an understanding of current Tennessee CPA licensure requirements, mobility, the history of the 150-hour requirement, and the national landscape related to proposed licensure changes.

Tennessee is not alone. State CPA societies and state boards of accountancy across the country are tackling workforce challenges in the CPA profession. Minnesota took bold steps in 2023 to introduce legislation to provide licensure pathways beyond the traditional 150-hour education requirement. Now more than 20 states have indicated plans to take action to evolve CPA licensure requirements. On Jan. 8, 2025, Ohio became the first state to enact legislation that provides for additional pathways to become a CPA and strengthens interstate mobility laws. At the time of publication, at least 10 states have already introduced legislation to broaden licensure pathways and/or take steps to safeguard interstate mobility, a practice privilege enjoyed by CPAs across the country and unique to our profession. The number of states pursuing statutory change is expected to grow in the coming months.

TSCPA Human Capital Strategy Task Force Recommendations

After much thoughtful consideration, the Human Capital Strategy Task Force made two recommendations to the TSCPA Board of Directors.

Recommendation 1

In response to changes that have occurred and will likely continue to occur across the country, the task force recommended that TSCPA pursue updates to the CPA mobility statute to ensure that current and future CPAs licensed in other states can continue to work across state lines. Modernization of CPA practice mobility strengthens existing interstate mobility laws, provides certainty and clarity for licensees, and ensures that the Tennessee business community and taxpayers continue to receive the CPA services that are needed to maintain a thriving economy in our state.

The task force recommended clarifying mobility laws to allow out-of-state CPAs who do not have a principal place of business in Tennessee the privilege to perform services in the state as long as the individual holds a CPA license in good standing from another jurisdiction and has passed the CPA Exam. Individuals who practice under this privilege would be subject to the jurisdiction and disciplinary authority of the board and must comply with the laws and rules of Tennessee.

Recommendation 2

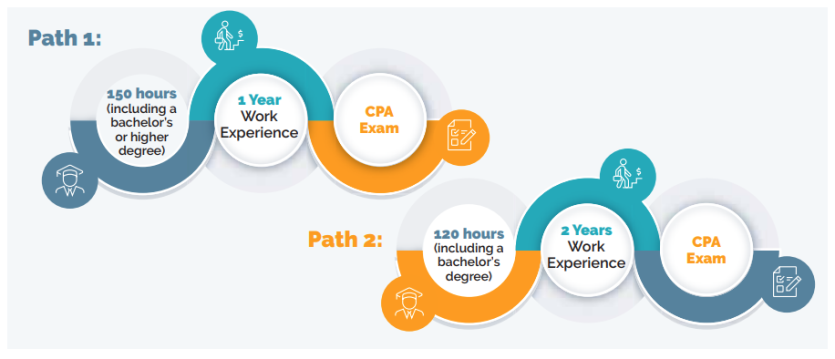

TSCPA’s task force also supported steps to address talent shortages facing our profession. The task force recognized the importance of reducing time and cost barriers that exist for some pursuing CPA licensure, providing flexibility dependent on each candidate’s unique set of circumstances, and creating a broader pathway that will support workforce development and, in turn, support the growing Tennessee economy. Specifically, the task force recommended three pathways to CPA licensure, which would allow for the traditional path of 150 hours obtained through either a master’s degree or bachelor’s plus 30 additional hours or an additional pathway of a bachelor’s degree with an increased experience requirement. It should be noted that the task force recommended that all educational pathways include an accounting concentration to ensure that candidates obtain the necessary accounting education needed to succeed as accounting professionals. The experience requirements for each pathway would be commensurate with the amount of education obtained: one year of accounting experience for the 150-hour path and two years of experience for the bachelor’s degree pathway.

Senate Bill 1316 and House Bill 1330

On Feb. 6, 2025, Senate Bill 1316 and House Bill 1330 were introduced, taking a critical step in addressing workforce challenges in the CPA profession. While the legislation differs slightly from the task force recommendations, TSCPA supports the legislation and believes that it will provide flexible pathways to licensure, provide students with options, maintain the rigorous standards required of CPA candidates, and most importantly, maintain public protection.

SB1316/HB1330 will broaden the pathways to CPA licensure.

- Pathway 1 – Applicants for CPA licensure must obtain a bachelor’s or master’s degree with at least 150 hours of college education. The coursework must include an accounting concentration as determined by Tennessee State Board of Accountancy (TSBOA) rule. Applicants for licensure under this pathway must complete one year of relevant accounting work experience.

- Pathway 2 - Applicants for CPA licensure must obtain a bachelor’s degree and at least 120 hours of college education. The coursework must include an accounting concentration as determined by TSBOA rule. Applicants for licensure under this pathway must complete two years of relevant accounting work experience.

The legislation also proposes to enhance and modernize CPA practice mobility. The proposal will allow current and future CPAs who do not have a principal place of business in Tennessee to practice in the state if they:

- Hold a valid CPA license in good standing from another state and if, at the time of licensure, showed evidence of having passed the Uniform CPA Exam.

Individuals practicing under the proposed interstate mobility provision consent to the jurisdiction and disciplinary authority of the TSBOA, to comply with the applicable statute and board rules of the state, and to cease offering services in Tennessee if their license in the state of issuance is deemed to be no longer valid.

This legislation is a key step in ensuring that the demand for skilled accounting professionals, specifically licensed CPAs, can be met now and in the future. It is necessary for Tennessee to lead on this issue and ensure we are evolving our licensure model to meet the needs of the profession, business owners and the Tennessee economy.

For more information and resources, be sure to visit TSCPA's Advocacy Center.

Watch the complimentary recording of the Member Town Hall Live Stream held on Feb. 17, where we covered this new legislation: Click for Details >