IRS Tries to Increase Audit Rates of Wealthy

In conjunction with the release of its annual Data Book for 2021, the IRS released a statement clarifying the steps the agency is taking to increase its audit rates of higher-income taxpayers.

The IRS released the statement in response to pressure from Congress as well as recent reports from the Treasury Inspector General for Tax Administration (TIGTA) and Syracuse University’s Transactional Records Access Clearinghouse (TRAC) that showed audit rates decreasing for higher-income taxpayers. In its statement, the IRS pointed out more recent audit data than the TIGTA and TRAC reports used that shows an uptick in audits for the wealthy and said that examination activity is often initiated later in the statutory period for higher-income taxpayers, as new exams can be initiated up to at least three years after a tax return is filed.

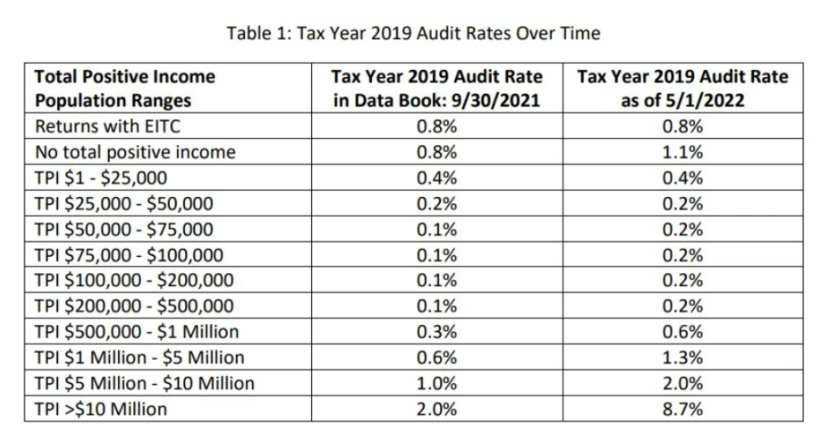

“The additional figures below show 2019 audit rates doubling in the last seven months for taxpayers in every income category above $100,000. For example, based on ongoing examination activity, audit rates for income categories between $500,000 and $1 million doubled to 0.6%. Audit rates for the $1 million to $5 million category more than doubled to 1.3% and taxpayers earning more than $10 million jumped four times — reaching 8%,” the IRS stated. The IRS included the following chart with the statement:

While the audit rates for taxpayers earning less than $50,000 remained stable, the audit rate for those with over $10 million in positive income increased from 2% in the fiscal year ending Sept. 30, 2021, to 8.7% in recent months. And although higher-income audits have increased, the IRS acknowledged that it is facing resource constraints, with fewer employees available with the necessary expertise to conduct audits of high-income taxpayers. The agency stated that there are approximately 6,500 front-line revenue agents in the field performing these types of exams.

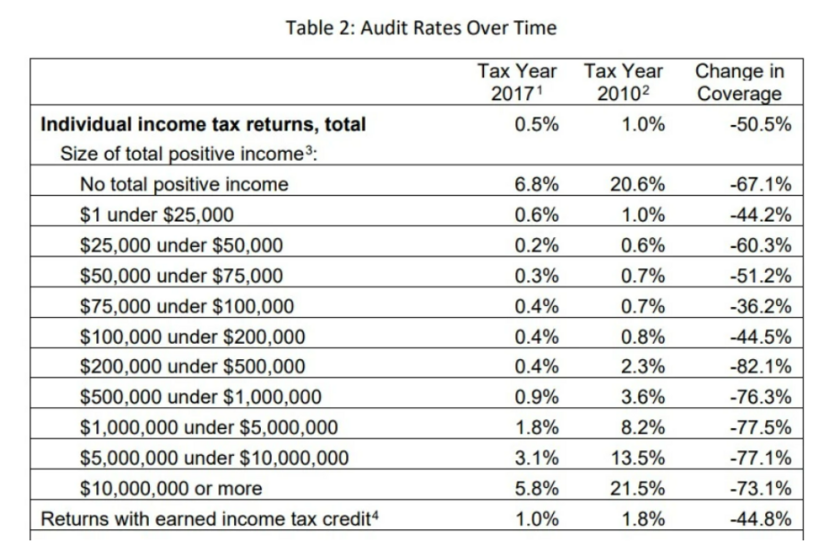

A second table provided by the IRS illustrates the overall disparity between its audit rates for higher-income and lower-income taxpayers:

During an oversight hearing in March, IRS Commissioner Chuck Rettig said that the IRS was not targeting lower-income taxpayers and called for the IRS to release the 2021 Data Book, which had not been released at the time. He said that the IRS audits high-income taxpayers more than any other category. Taxpayers reflecting over $10 million of income are audited at a rate exceeding 7% compared to taxpayers at the $25,000 level, who are audited at 1.1%.